With our economic outlook for local economies now online, Rob Hall shares some common themes we’re noticing as we work with councils to develop their local response to Covid-19. Rob looks at the disproportionate impact on women and younger workers, the need for an extension to the federal government’s support packages, and demonstrates how to see which industries and residents have been impacted in your area.

He also previews an extended economic forecast module the team have been working on, as many councils have asked us to explore what their economy will look like after the June Quarter 2020. Your opportunity to preview and provide feedback on that module, below.

Jump ahead

We have been working with many local councils across Australia with their recovery plans. Several themes have emerged from the work we have done so far;

1. Extended support is required

While restrictions are being relaxed in many parts of Australia, we are starting to see the economic impact of a sharp fall in hours worked and rising unemployment on demand for goods and services across the economy. This was highlighted today by reports that Qantas will cut at least 6,000 jobs across all parts of the business as part of its long-term response to the coronavirus pandemic.

This demand shock will see business investment fall over the coming months with many projects cancelled or postponed until the economy starts to recover. Professional services are particularly sensitive to this. And while construction investment is less impacted in the short run, it is likely to experience impacts beyond June.

On top of this, the International Monetary Fund has downgraded its economic forecasts and now sees the world’s Advanced Economies contracting by 8 per cent this year. A fall in economic activity in our trading partners will heavily impact Australian exports over the coming quarters and will impact many regions across Australia.

Our economic forecasts are helping inform these discussions about what support is required across sectors and regions. In particular, our analysis has identified the urgent need to extend JobKeeper beyond September 2020 as its removal will lead to significant job losses.

Isolating the employment benefit of JobKeeper

Our analysis separates the number of workers on JobKeeper who are not working.

For example, our analysis for Cairns showed that around 5,700 workers would be out of a job if it wasn’t for JobKeeper. This is the case for many locations across Australia, and the removal of JobKeeper in September is likely to have a significant negative impact and delaying economic recovery.

2. Impacts fall disproportionately on women and younger workers

An analysis of the worker profiles shows that women and younger workers have been hit hard by the impacts of COVID-19.

Glenn previously wrote about the Weekly payroll jobs and wages survey the ABS has been conducting since March, which shows the change in payroll jobs over that period. The chart below is from that same survey, and clearly shows women have been disproportionately impacted.

Source: 6160.0.55.001 Weekly Payroll Jobs and Wages in Australia, Week ending 30 May 2020

Who is being affected in your area?

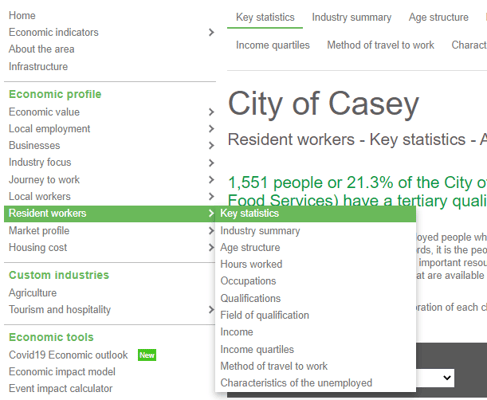

For a closer look at who is being affected in your local government area, open your economic profile and combine the analysis from our Covid-19 economic outlook tool with the resident worker analysis in economy.id to understand which industries are being most affected, and the characteristics of workers in that industry.

Find an economic profile for your area here.

Covid-19 economic outlook

Find this data in your economic profile

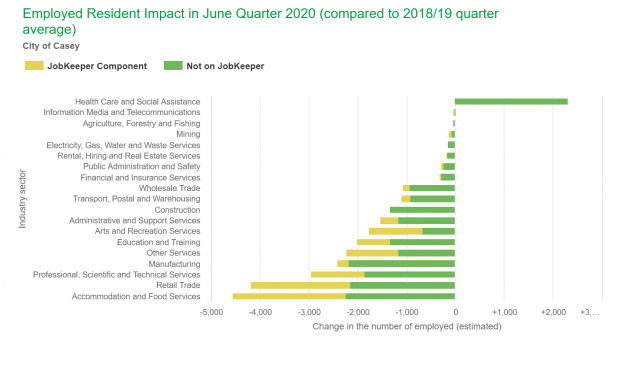

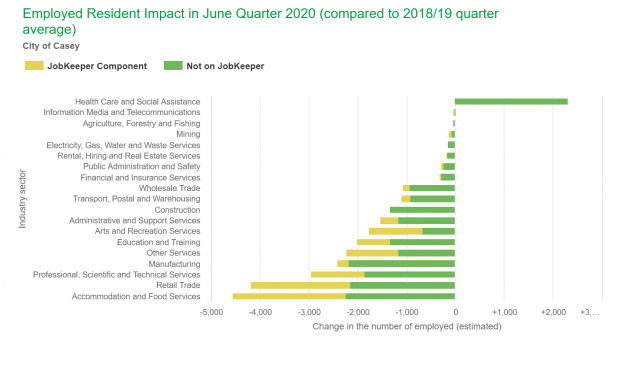

Using the City of Casey, a growth area in Greater Melbourne’s outer South East, as an example, we can see Accommodation and Food Services has been the industry hit hardest by Covid-19, with an estimated change in employment of around 4,500 people, compared to the 2018/19 quarter average.

Who works in this industry?

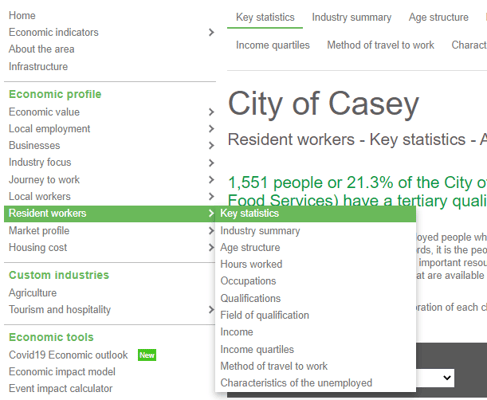

Now, select Key statistics from the Resident workers menu in economy.id (or the Local workers menu if you’re undertaking a local jobs, rather than a employed resident analysis).

Then, choose the industry to see the characteristics of the workforce. Using Accommodation and Food Service as an example, we see that 55.2% of Casey City’s resident workers were female, and 51% were aged 15-24. This highlights that the impacts in Casey are likely to fall on female and younger workers.

3. Tourism regions will need special attention

The tourism and hospitality sector is a substantial contributor to many metropolitan and regional economies across Australia. Significant job losses are expected in important tourism and hospitality sectors like Accommodation, Cafes/Restaurants and Entertainment.

Locations reliant on interstate visitors and international visitors are likely to take longer to recover. For example, in Coffs Harbour the value of international visitors to the Coffs Harbour economy is estimated at $65m per year. While this is only 1% of economic activity, to counter the fall in international visitation, Coffs Harbour would need to increase domestic overnight visitors by around 5% (or 125,000 domestic overnight visitors).

Preparing the response in your area

Short and long term focus

These themes suggest that there will need to be both short and long term actions to support sustainable economic growth. The long-run damage to the economy from the impact of COVID-19 will stem from:

- Disruption to export markets and supply chains

- Lower household spending

- Government debt

- Increased debt by businesses

- Reduced job generation (e.g. increased acceptance of online shopping with this having implications for shopping centres and high streets).

- Negative effects on the longer-term outlook for commercial property

- Impact on younger workers and women workers

- Flight to low risk, large job pool locations

Identifying the highest-value opportunities

This means that there is a need to identify priority projects that support short term employment opportunities but also make strategic sense for the long term.

Criteria we use in our consulting projects to prioritise projects include:

- alignment with region’s competitive advantage (download a copy of our free grant application guide for a step-by-step instruction on how to identify your LGA’s competitive advantages)

- addresses market failure/ barrier to investment

- payback horizon (how long does it take to capture full benefits)

- ongoing employment generated and financial impact on Council

Extended economic forecast module

Since March, we have had a number of councils request information that helps them better understand the possible recovery path post-June Quarter 2020, to aid in policy development and to provide an evidence base for conversations with State and Federal Government.

To meet this need, our team have been working on a new forecast module in our economic profiles that will provide extended economic impact forecasts to the December Quarter 2021.

These forecasts will available as an optional upgrade to economy.id for existing subscribers (they will not be available as stand-alone forecasts).

Current module design

The module is currently being designed but is likely to include two scenarios that will highlight the impact if JobKeeper is not extended beyond September. This information will help support discussions with State and Federal government.

This module covers the likely economic impact of COVID-19 on local economies, with detail including:

- Quarterly data from June 2019 to December 2021

- 2 scenarios – with and without JobKeeper

- GRP

- Jobs

- Value Added

- Industry insights (1 and 2 digit)

Your feedback

We would like to hear from you to ensure the design of these extended economic forecasts to ensure they support the decisions, funding submissions and advocacy work you will be conducting in the months ahead.

Contact our team at economics@id.com.au or send us your feedback here.