Early last year, I had the opportunity to work with the City of Monash to develop a strategic economic profile of the council area. It was a rewarding and interesting project as I got to explore one of Australia’s true innovation clusters.

‘Innovation’ has been a catch cry of multiple governments over the past couple of decades as they seek to spruik Australia as more than just an open pit mine and also to counteract declining labour productivity growth. Going hand-in-hand with innovation is the encouragement of spatial concepts such as clusters or innovation precincts.

A little on clusters

The concept of industry clusters came to prominence in the early 1990s. Michael Porter was one of the most influential proponents of the competitive advantage gained by similar firms or sub-industries locating in close proximity to each other. He argued that inter-firm cooperation and competition breeds innovation and productivity improvements.

However, Porter’s work essentially built on much earlier ideas of industrial localisation, most notably those of Alfred Marshall. One hundred years before Porter’s cluster concept, Marshall detailed the advantages generated by skilled people in similar trades co-locating.

Such advantages include the development and uptake of new ideas, the shared use of specialised expensive machinery, and greater efficiency in supply and demand of skilled labour. These benefits are now commonly associated with the concept of economies of agglomeration.

Fast forward to the current day, and the rise of knowledge-based industries has re-established the exploration and encouragement of clusters. Interaction between firms and institutions is said to be the basis of innovations in clusters and the benefits of ‘knowledge spillovers’ is thought to be a large driver of industry concentration.

However, despite many governments’ best efforts to grow innovative clusters overnight, most existing strong clusters have evolved over time based on locational advantages, economic trends and the strengths of key assets.

Monash – a centre of innovation

So, does Monash (in Melbourne’s inner-South-East) contain a strong cluster? And, does this support innovation and new business development?

There is no doubt that that the City of Monash has a large concentration of businesses, institutions and employees.

In fact, it is Greater Melbourne’s second largest economy by Jobs and Gross Regional Product (GRP) – the first, of course, being the City of Melbourne. It also has world-class facilities including Monash University, Monash Medical Centre, the CSIRO, the Australian Synchrotron, and the Australian Regenerative Medicine Institute (ARMI).

However, concentration alone does not make a cluster. True industry clusters contain specialisations and are built around what can be described as related diversity. This simply means that there is a concentration of different types of enterprises that are linked by related supply chain activities.

Over time, Monash has developed key specialisations in a number of linked sub-industries. For example, scientific research services are over-represented when compared to the rest of Greater Melbourne, but so are scientific testing services, scientific equipment manufacturing, and scientific goods wholesaling. There is no doubt that these industries also rely on a steady stream of science graduates and associated scientific research training at Monash University. Businesses have established relationships and partnerships over time that have probably facilitated new product development and more efficient processes.

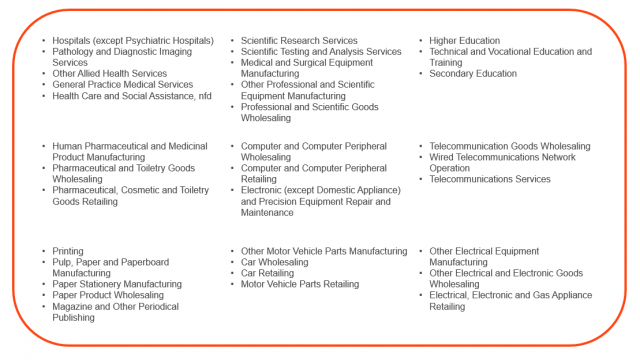

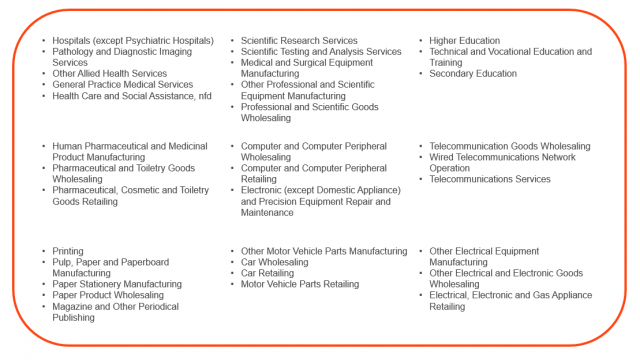

The area could actually be defined as having multiple thematic based clusters as there are other areas of related diversity. Some of the key linked industries where the City of Monash has a specialisation in are presented below.[1]

What makes a collaboration cluster?

What makes a true ‘innovation’ cluster though is collaboration between players.

What I found during my research is that this happens all the time, especially within the National Employment & Innovation Cluster – a geographical area that includes the Monash Technology Precinct and the Monash Health & Education precinct.

Some of these collaborations/partnerships include:

- The Monash Health Translation Precinct is a collaborative initiative of Monash Health, Monash University and Hudson Institute of Medical Research to strengthen links between education and training, basic and clinical research, and patient care.

- The New Horizons Research Centre is a new building which co-locates and integrates around 500 staff from Monash University and the CSIRO to provide platforms for global research and teaching collaboration through state-of-the-art information technology and research equipment that facilitates greater linkages with business and the community.

- Regenerative Medicine Industry Interface is a consortium involving Monash University, ARMI and the Monash Institute of Medical Engineering (MIME), CSIRO, the BioMelbourne Network and other research institutes to accelerate commercialisation and translation of academic research into products and solutions for industry.

- The Monash Centre for Additive Manufacturing works with research and industry partners to invent bespoke solutions to unique manufacturing challenges.

- The Melbourne Centre for Nanofabrication is a world-class nanofabrication centre, combining cutting-edge technologies with the knowledge and skills of expert process engineers. The MCN is a joint venture between six Victorian Universities and the CSIRO and is openly accessible to any researchers in academia, CSIRO or industry.

The outcome of all this collaboration?

Well, illustrating its role at the centre of innovation in Victoria, in the ten years between 2006 and 2015, 1,254 patent applications were filed in the City of Monash. This represented 7.6% of Victoria’s total patent applications – considerably more than the area’s share of jobs (4.1%) or businesses (3.4%). Also, between 2012 and 2016, average growth in businesses numbers in the City of Monash was 1.76% p.a., more than double the Victorian growth rate (0.83%) and five times the Australian rate (0.35%).

Maintaining innovation potential

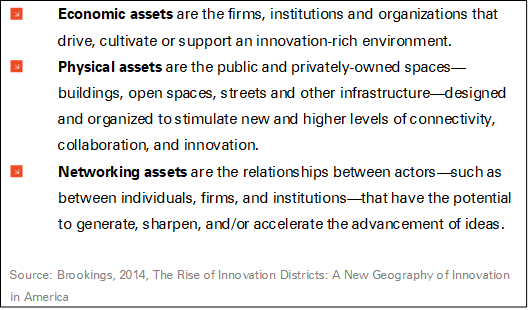

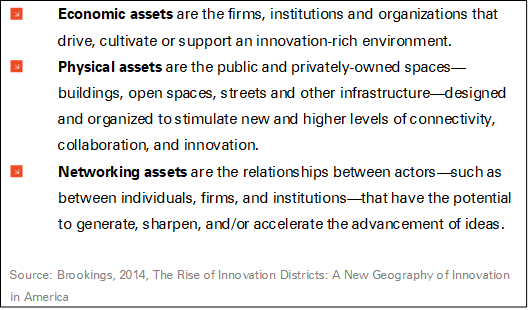

The Brookings Institute did some work a few years ago on identifying what factors enable strong innovation precincts. They showed that having a lot of businesses, organisations and workers alone is not enough. Physical and social assets within an area also support the ability of these players to interact, connect and collaborate.

It is rewarding to see the council realise the importance of continuing to support innovation and enterprise by working on the physical and social connections, not just basic business support.

Key objectives are centred on boosting collaboration, improving accessibility to key precincts and enabling transitioning industries (e.g. manufacturing and wholesale) to adapt to new technology/processes and the changing spatial demands this creates.

The draft Monash economic development strategy (including our detailed economic profile) is out for public discussion until 23 February.

If you would like advice or assistance in economic development strategic planning, get in touch with our consulting team and tell us what you’re working on.

.id is a team of demographers, urban economists, spatial planners and data experts who use a unique combination of online tools and consulting to help governments and organisations understand their local economies. Access our free economic resources to help profile your local economy.

[1] Industries chosen based on links, 150 jobs or more (ABS Census 2011), and a Location Quotient (LQ) >1.2 (over representation against Greater Melbourne shares)