A cautionary tale! Georgia shares an easy trap to fall into when looking at affordable housing supply to the detriment of some of the most vulnerable in the housing market. She then shares why it’s a trap, and the importance of affordable rental supply.

Already know that affordable housing supply is an issue in your area? Our free guide might help. You can download your copy of How Councils can influence affordable housing here,

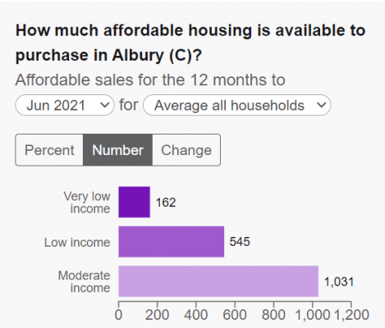

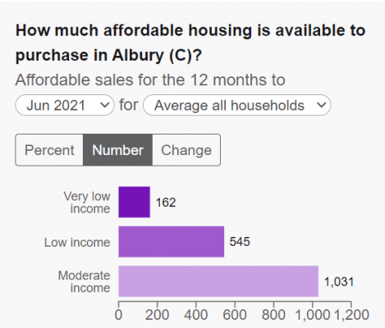

I fell into a trap recently. I was looking at the data for one of our housing.id clients, Albury City Council, and noticed that there had been more affordable sales in the last 12 months than there were affordable rental listings. As you can see in the charts below, in the 12 months to June 2021, 162 sales were affordable for very low income households, compared to 103 rental listings.

Great! I thought to myself – more people will be able to buy their own home. For most people, this is their preferred tenure type. But then I thought about it from a practical sense. Could these very low income households really purchase a house?

Buying a house requires a significant amount of money upfront, to cover the deposit, stamp duty and other fees. Many very low income households don’t have access to this level of savings. Take for example, the entry level (25th percentile) unit price in Albury of $220,000. In order to have a 20% deposit, cover stamp duty and other fees, $51,000 in savings would be required.

Based on the income of very low income households in Albury, of $32,135 per annum, and a standard household savings ratio of 15% a very low income household could save $4,820 per year. At this rate of savings, it would take around 11 years to save the necessary deposit for an entry level unit. The standard household savings ratio is problematic in this scenario – while its used by many major research bodies, including CoreLogic in the housing space – it’s unlikely that a very low income household would be able to save 15% of their income each year. If a more conservative (but still probably too high for this income group) savings ratio is used – for example 5% – a very low income household could save $1,610 per year. At this rate, it would take 32 years to save the $51,000.

As you can see, this house purchase is not really a practical solution, especially as the need for affordable housing is an immediate need for households – not something they can generally wait 32 years for!

This shows just how important it is to have affordable rental stock in your local area. Renting has fewer upfront costs and is a more practical solution for very low income households -some of the most vulnerable – in the short term. There are number of ways Councils can positively impact the supply of affordable rental housing in their area. You can read about them in our free guide. You can download your copy of How Councils can influence affordable housing here,