Our economics team have been working with NIEIR to model the impacts of COVID-19 on local and regional economies across Australia. In this blog, Rob Hall recaps yesterday’s webinar where he shared the early results of that work, and the framework you can use to understand how the economic effects of the pandemic may affect your region.

The webinar| Watch the webinar here, including his live answers to Q&A from the many local government officers who joined us.

Qs&As | Stay tuned to our blog in the coming days as we will be sharing some of the terrific questions, particularly from the local government sector, from today’s webinar, and sharing our answers and recommendations.

Stay up-to-date with the Covid-19 outlook tool | Register here to receive updates and be notified when our economic outlook tool for local government areas is available.

Applying a regional lens to the economic impacts of COVID-19

In response to the need for more information at the sub-state level, .id and NIEIR is releasing a COVID-19 Outlook tool to show the economic and industry impacts at the LGA level. This tool will focus on the June Quarter 2020 impacts of the pandemic. The forecast model estimates the direct impacts of COVID-19 on final demand (e.g. household spending, business spending, exports), the multiplier effects and makes assumptions about the effectiveness of health and economic measures. This blog provides some early insights from NIEIR’s forecasts.

Understanding the impact of COVID-19 on local economies, as well as the effectiveness of economic stimulus, will be critical in developing targeted actions over the coming months.

National impacts

COVID19 will obviously have a substantial negative impact on economic activity in 2020, with the recovery effort lasting for many years. NIEIR and .id’s focus now is on understanding the Q2 (Apr-June) impacts in 2020. This is because the recovery depends on the development of a vaccine and the effectiveness of economic policy. The economy is in uncharted territory – nobody knows for sure how the economic measures will work.

Based on the preliminary forecasts from NIEIR, which incorporate the policies announced to date, the estimate is that National Gross Product in the June quarter will fall by around 16.6%. The fall in employment is forecast to fall by around 1.5 million, if we assume that job keeper recipients are treated as employed (i.e. working 0 hours). But the fall is much greater, at around 2.9 million, if we assume jobkeeper recipients are unemployed.

The JobKeeper scheme is particularly important for two reasons. The first is that it outsources Centrelink payments to businesses, and supporting household income. The second is that it avoids the direct stigma of formal unemployment status. This is an important move from a confidence perspective, and without it, rapidly rising unemployment would severely impact households’ medium-term expectations.

Sectoral impacts

Modelling by NIEIR shows that COVID-19 will impact some sectors more than others with several factors at play.

The falls in economic activity in our trading partners, which will be on average around 5% for the 2020 calendar year, will heavily impact Australian exports over the next nine (or more) months.

Additionally, the social distancing measures will see economic activity related to accommodation, entertainment, arts and restaurants fall significantly. These sectors represent a large share of tourism values for many regions in Australia. The decline in foot traffic has induced many establishments to close as well. Many business inputs will also not happen or be postponed, with the business services sector very sensitive to uncertainty and confidence levels.

But spending on food retailing, health and telecommunications is expected to increase.

Framework for assessing regional impacts

Local Government Area (LGA) impacts

The results at the Local Government Area level are still being reviewed and we will update this blog when they are available.

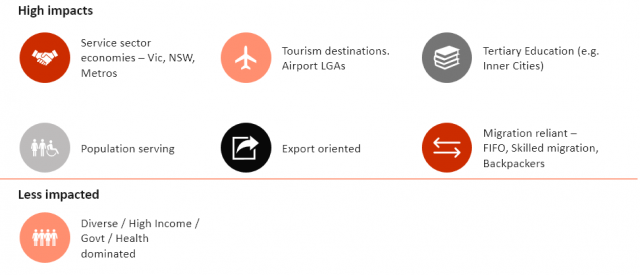

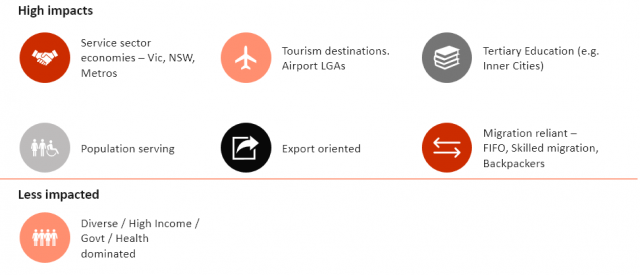

Based on an analysis of the preliminary forecasts, it is unsurprising that regions will be impacted to different degrees and will depend on the region’s role and function, export reliance, sectoral mix and exposure to the virus. Understanding the ‘pre-Covid’ baseline of economic conditions in your local area is a critical first step in developing strategies to combat the impact in the recovery phase (we provide a framework for creating this baseline in your area here).

Based on the preliminary forecasts from NIEIR, the impacts are generally higher on service sector economies. New South Wales and Victoria experience the largest impacts given the importance of services to their economies. At a sub-state level, the impacts are higher in the metropolitan areas again because of their service sector economies.

Regions

But this is not to say the impacts won’t be high in some regional areas.

Regions reliant on tourism and hospitality are particularly vulnerable to the impact of social distancing measures. Looking forward, it is likely that domestic tourism may pick up at the back end of 2020, but areas that attract international visitors may experience a slower recovery.

Similarly, regions which are overly dependent on population-serving sectors (which are generally low-income based) will be vulnerable to falling household expenditure.

Metro

Inner cities will experience mixed results, which highlights the importance of economic diversity. On one hand, inner cities are less vulnerable because of their high share of public sector and health workers. But they are also exposed due to their comparatively high level of exports (e.g. tertiary education) business services and businesses reliant on high activity levels from workers, tourists and residents.

Long-run impacts

There are also substantial permanent long-run risks to the economy. The long-run damage to the economy from the impact of COVID-19 will stem from:

- export markets and supply chains have been disrupted and may not be re-established post COVID-19

- wealth impacts (lower asset values, increased debt) by the household sector weakening long-run spending capacity

- increased government debt requiring higher tax rates and lower expenditure

- increased debt by businesses reducing internal cash flows to support investment

- lower population growth (especially from lower overseas migration), with adverse impacts for housing activity and the economy

Peter Brain, Director of NIEIR, has also pointed out that it is also possible, given the above, that the recovery may trigger a financial crisis (risk-off shocks), threatening to turn the COVID-19 impact into a longer-term depression. For further explanation see P.J. Brain and I. Manning “Credit Code Red: How financial deregulation and world instability are exposing Australia to economic catastrophe” (Scribe, Melbourne 2017).

Implications for local economic development

One of the key questions facing local government is what they can do to help their economies rebound from the economic shock. The answer to this question depends largely on the drivers, risks and weaknesses of the local economy. But generally, the impacts are likely to have a range of implications for local government strategy, some of these are presented in the table below.

In response to the need for more information to inform these strategies, .id and NIEIR is releasing a COVID-19 Outlook tool to show the economic and industry impacts at the LGA level. This tool will focus on the June Quarter 2020 impacts. This information will provide an understanding of which industries and regions are most impacted by COVID-19. Mode detailed modelling can be undertaken as a consultancy.

When coupled with an understanding of a region’s economic drivers and industry mix (see our recent blog on how to create an economic baseline), this information can help local government develop targeted actions over coming months.