Last week I presented a paper to the Urban Development Institute of Australia’s South Australian chapter (UDIA SA). The brief from the UDIA was ‘ talk to us about the implications of changing demography on housing demand in Adelaide’.

I felt compelled to not just describe changing housing demand as if it’s demographic change is the sole influence, but to look at what the context driving demand for housing in the state, which inevitably brings an understanding of the role and performance of the state’s economy into the picture.

I therefore took the audience on a circuitous journey through migration, needs of the new economy and what role housing plays in the future of the State’s success. Here is a cut down transcript of the presentation.

Aspects of success

Levels of Overseas migration in South Australia, as for our nation, plays a fundamental role in the state’s economic and social success.

Net migration flows 2011 – 2016

Source: ABS Census of Population and Housing, 2016 The gains to SA over the intercensal period we’re almost entirely from overseas, gaining more than an average of 10,000 people per year. This is over 30 times more people than the only other place SA makes a net migration gain (NT).

Age profile of recent Overseas arrivals, South Australia

Source: ABS Census of Population and Housing, 2016

South Australia’s Overseas arrivals are young, skilled and fertile!

Yes, they not only bolster the population by contributing to net gains via migration, but they have babies too. They are in what demographers call, “the highly fertile age groups”.

They are increasingly Indian and Chinese, bringing with them cultural uniqueness and economic growth. Each of these countries are diverse places in themselves, representing multiple religions, languages and ethnicities.

Along with this cultural evolution, Adelaide is evolving economically. It is gradually making a transition from a 20th-century city to a 21st-century city. But this transition is fragile. A fragility brought about by the sheer dominance of the Australian economic transition occurring in Sydney and Melbourne. Just as Australia competes with other advanced western and emerging eastern economies for skilled migrants, South Australia competes with the other states.

However, as South Australia gains from Overseas, loses young skilled people to the eastern states.

Source: ABS Census of Population and Housing, 2016

In Adelaide we raise them, educate them, and then lose them. This is undoubtedly a blow, but it needs to be addressed by better understanding the essential planks required for success in the new economy.

The good news for Adelaide is that globally, cities of 1 million or more are the powerhouses of the new economy, that seems to be the threshold which can maintain a critical mass of people to maintain a sustainable population base.

What we have learned about the cities of the 21st century is that ideas rule.

The more ideas-per-square-metre you can achieve, accompanied with world-class ‘enabling’ infrastructure and environment and amenity, then the more successful your place will be in the new economy.

I f you look at Adelaide, in many ways it is a museum example of a 20th-century city, also like parts of Melbourne and Western Sydney in particular.

Big swathes of land use separated for manufacturing, commercial, residential. Almost entirely car-dependent. While jobs have been growing largely associated with population growth.

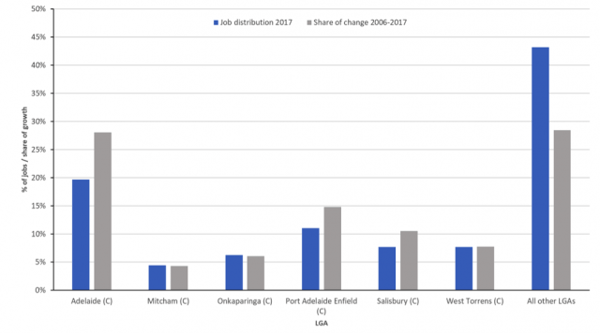

Nevertheless, Adelaide appears to be in transition. We can see some evidence of this by the change that is occurring in the distribution of jobs across Adelaide.

We are seeing two types of jobs growth across Australian cities; one is economic growth associated with population growth, accounting for most of the jobs growth in the suburbs (where the population is growing); and two, is the growth associated the transition to the new economy. Most of this growth is happening in and around the CBDs of Australia’s cities, as well as some key centres of agglomeration.

We are seeing two types of jobs growth across Australian cities; one is economic growth associated with population growth, accounting for most of the jobs growth in the suburbs (where the population is growing); and two, is the growth associated the transition to the new economy. Most of this growth is happening in and around the CBDs of Australia’s cities, as well as some key centres of agglomeration.

The success of the CBDs of Australian cities is proof of the importance that agglomeration and long-term infrastructure investments such as cultural galleries, train stations, sports stadiums, hospitals and universities, all which play important roles in the transition to the new economy.

Herein lies the challenge for Adelaide and for the urban development industry. Note in the above slide, while the rate of jobs growth is highest in the CBD, there are more jobs in the suburbs. The question is, what if we applied the CBD agglomeration approach to the suburbs? Can we generate more jobs? Different types of jobs? More high-value jobs?

As participants in the development industry, my audience wanted to maintain and increase demand for their products and services. Therefore, we need to understand the importance of urban form and how participating in the agglomeration of Adelaide holds the key to its future.

World Class Education Institutions are essential

Let’s assume, not unreasonably, that South Australia will continue to lose young people interstate for opportunity to the eastern states.

If that’s the case, Adelaide cannot afford to lose the net gains of overseas migrants, many of who arrive as students. World class education institutes therefore for a key plank of South Australia’s attraction.

People, migrants and Adelaideans are well aware of a pleasant lifestyle. The weather, the coast, the hills, quality food, wine, social cohesion. However sufficient economic opportunity is missing.

You may ask, what has all this to do with housing consumption trends?

The type and location of housing is essential

If ideas are the stuff of the new economy and people are the raw material, then having the right environment for successfully nurturing these ideas and implementing them in a way that drives productivity, then the type and location of housing plays a key role. This is another key plank for Adelaide’s success.

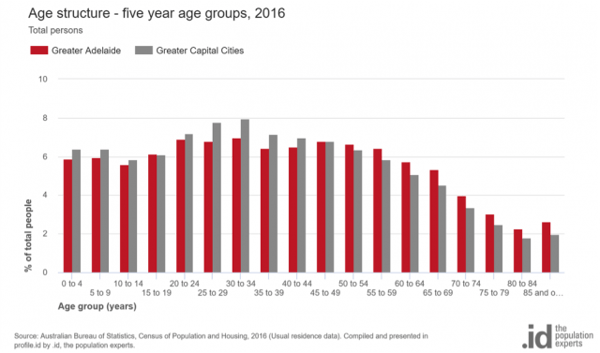

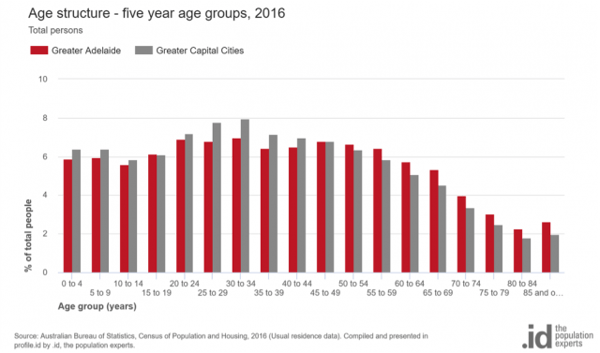

Age structure of Greater Adelaide 2016

Is South Australia’s population ageing?

South Australia’s population is ageing! Have you heard that?

Well that’s not entirely accurate.

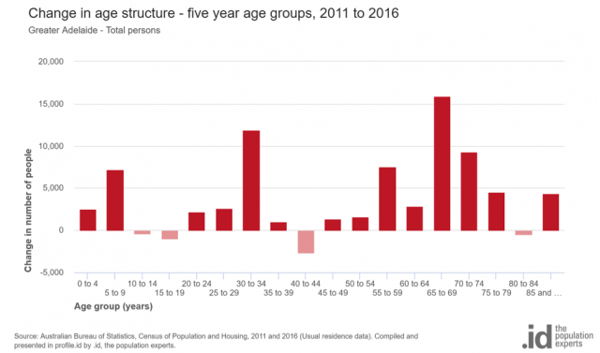

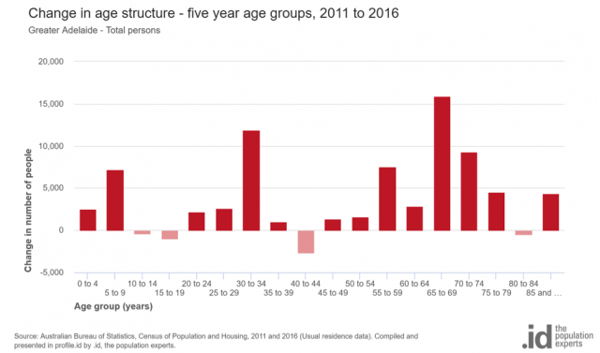

Change in age groups in Adelaide 2011-2016

Over the last intercensal period, there are in fact three growth markets: the boomers; young adults (20 to 34 year-olds); and their children (0 to 9 year-olds). Growth was largely driven by overseas migration.

Net change in Household types, Adelaide 2006 – 2017

Source: ABS Census of Population and Housing, 2016

We have seen associated growth across all household type groups, dominated by ‘couples with children’ but if you combine the smaller household types, couples and lone persons, these ‘smaller’ households would dominate.

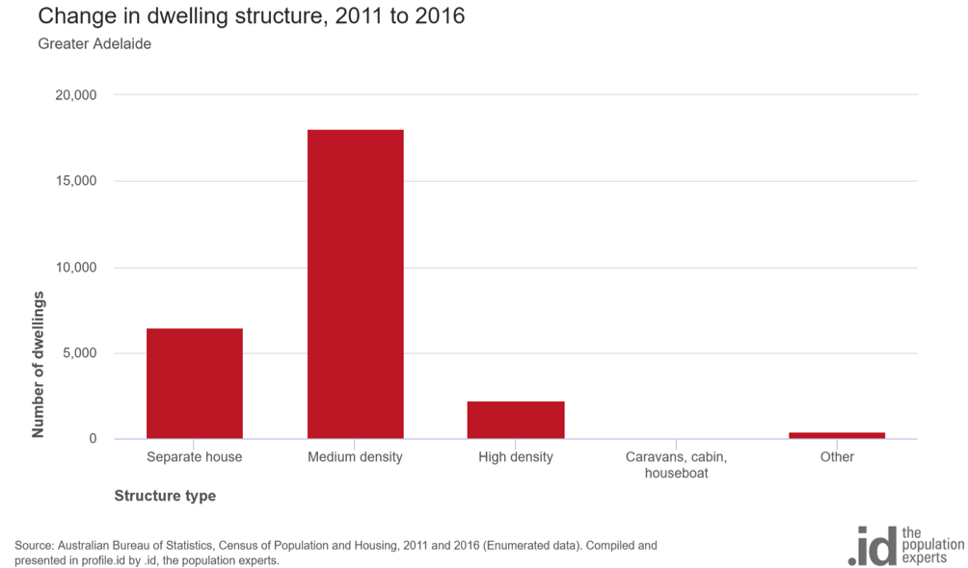

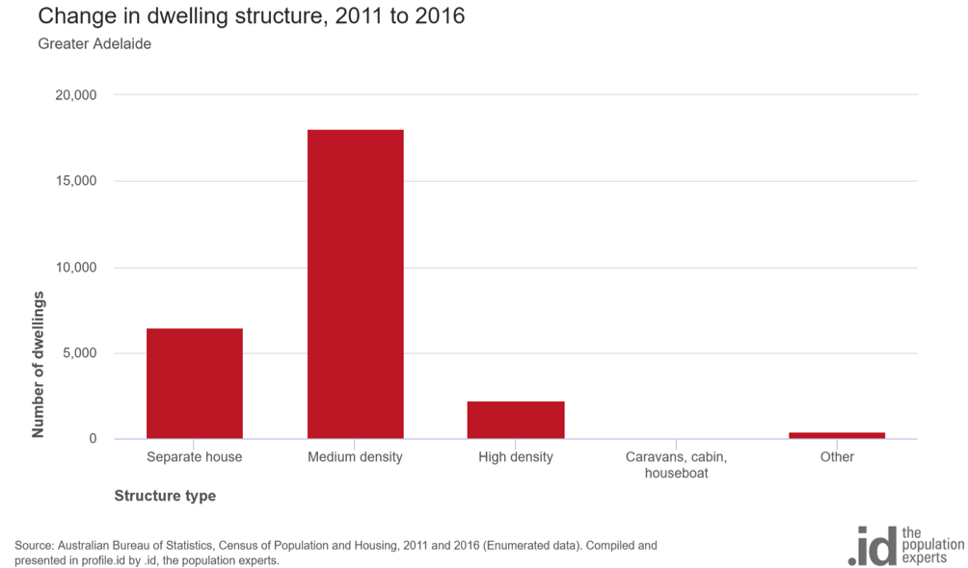

What types of dwellings have we been building? There appears to be a market response to these household or ‘demographic’ changes because there has been a big net gain in ‘higher density housing’.

Net change in dwelling types, Adelaide 2011 – 2016

Further, Adelaide has recently achieved a high level of development in established areas, increasing from 47% to 62% in the latest intercensal period. Well below Sydney but closely following Melbourne.

Share of development in established areas of major cities over 25 years

Source: ABS Census of Population and Housing, 2016

Adelaide is densifying

Where is Adelaide’s densification occurring?

Medium density dwellings across greater Adelaide, 2016

Source: ABS Census of Population and Housing

Adelaide is displaying a trend toward the densification of the well-established areas and there seems to be a strong association for this to be occurring in and around the established centres, with the exceptions of the more outlying centers.

There is a relationship between jobs and higher density housing

There is a correlation between residential densification and job growth in and around these centres.

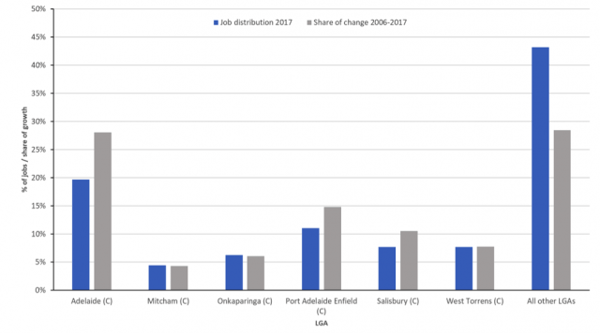

You can see, while total job numbers are large throughout the suburbs, jobs growth per se is occurring most recently in the agglomerate centers of the Adelaide CBD, Port Adelaide Enfield and Salisbury (Mawson Lakes?), represented by the grey bars.

Distribution of jobs and share of change 206 – 2017 jobs – Top LGAs

There is a correlation between residential densification and job growth in and around these centres.

You can see, while total job numbers are large throughout the suburbs, jobs growth per se is occurring most recently in the agglomerated centers of the Adelaide CBD, Port Adelaide Enfield and Salisbury, represented by the grey bars.

How does Adelaide’s densification compare?

Finally, how is Adelaide performing with regard to the role that medium density dwellings play in cities adapting to the new economy?

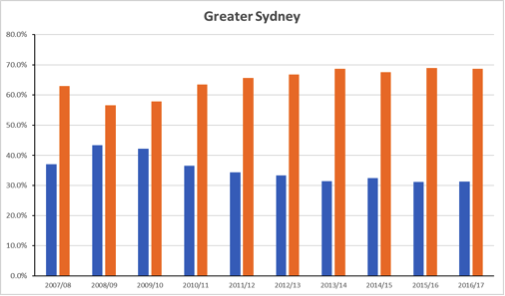

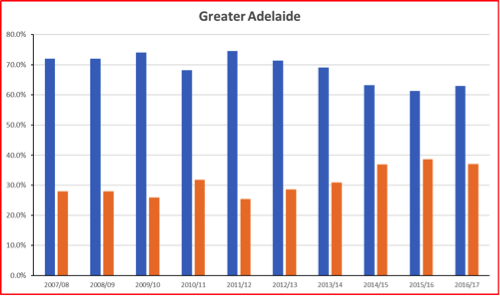

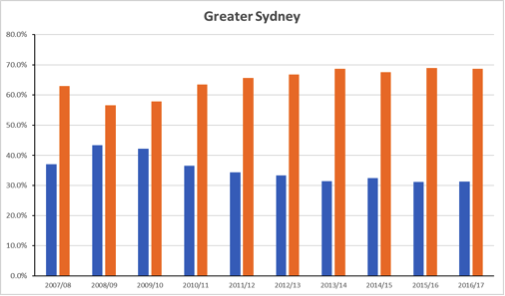

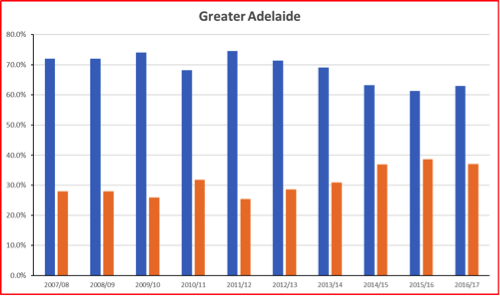

Share of residential building approvals – capital cities 2007 – 2017

NOTE: The blue bars are Separate dwellings, the orange bars are Medium and high-density dwellings.

Source: ABS, Building approvals Cat. 8731.0

We can see that the share of medium and high-density dwellings is well established and dominant in Sydney; has clearly emerged in Melbourne and Brisbane; with Adelaide having some way to go.

If “Demography is Density!”

If ‘demography is destiny’, then understanding what drives the migration component of a population change in South Australia is paramount. We know that in the Australian context there are direct and intricate links between the economic performance of a place and the propensity of people to arrive or leave.

The challenges for the South Australian development industry (and for the state as a whole) are threefold:

Firstly, we need population and household growth to generate demand for our products and services.

Secondly, to achieve this, Adelaide needs to transition to the new economy as rapidly as possible if it is to maintain population growth.

And thirdly, the type and location of housing we build is a central plank to the economic success of Adelaide (and South Australia). Adelaide will need to successfully achieve significant commercial and residential agglomeration as an urban form to successfully participate in the nation’s transition to the new economy.

How can developers help this transition?

While there is evidence this transition is occurring, if you work in the development industry, it would be great to hear how you think you can contribute to the rapid achievement of this transition.