.id was recently commissioned to undertake a study looking at greenfield developments to better understand the likely demographic composition as these estates become fully developed and begin to age. The results of the study were extremely interesting and challenge some of the assumptions in used in planning greenfield estates, and the likely futures experienced by these estates. In particular a number of effects were observed which are related to affordability.

Greenfield estates serve the family housing market, providing affordable detached family housing with 3 or more bedrooms. Typically, greenfield areas undergo rapid development and population growth over a relatively short period, depending on the size of the release. Prior to development there is little or no population, whereas newly developed estates are characterised typically by young couple or families with children.

This occurs because newly developed greenfield estates are relatively homogenous in terms of their density and housing stock, and are marketed to people willing to trade accessibility to employment and social amenity in exchange for affordable family style housing. The demand for this type of housing has traditionally appealed to people aged 25-34 years, either with young children (aged 0-4 years) or looking to start a family in the future. The lower price point for a house and land package, together with potential stamp duty savings, means that new estates are particularly attractive. Although, notably, there has been a trend to provide medium density ‘townhouse’ type dwellings, and even higher density apartments within developing areas, these traditionally account for only a small proportion of total stock and are aimed at providing an affordable product to the first-time homebuyer market. What is more uncertain are the demographic changes that are undergone on an estate as it ages, and the changing service requirements of their population.

The hypothesis

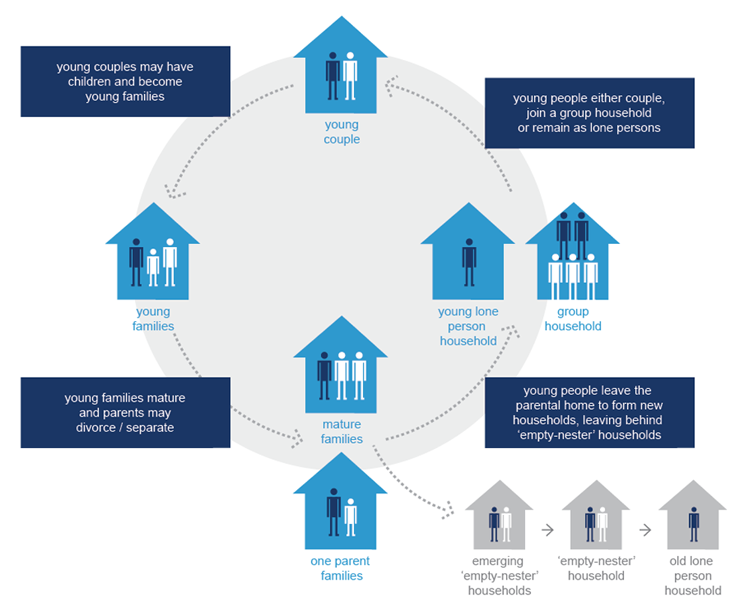

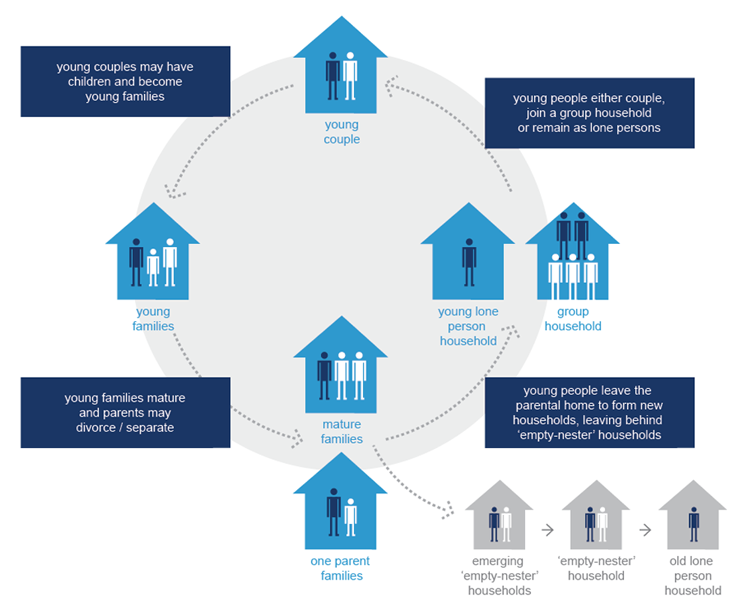

A greenfield estate would be expected to follow a suburb life-cycle as its ages (shown in the chart below), developing a more diverse age and household structure and experiencing a fall in average household size.

Once a greenfield estate has been built out, there is unlikely to be any additional residential development given all available sites will have been utilised, and the housing will be approximately of the same age and unlikely to be replaced or subdivided over a twenty to thirty-year period. Families are likely to age in place, and children will grow up and leave home, meaning that there will be a higher proportion of older persons and smaller households as time progresses. Larger numbers of older people mean a greater number of smaller households (empty-nester and lone person households); therefore, falling average household sizes would also be expected.

What did we do?

The study looked at 81 estates in Victoria, NSW and WA which ranged in age: developed between 30 years ago to still developing. The age profile of each estate was looked at for 2006, 2011 and 2016, top give three points of comparison, and were compared to 3-benchmarks, 3 selected estates that represented the expected age structure for a recently developed estate, an estate developed in the late 1990s and an estate developed in the late 1980s. The average household size was also calculated, using the Census count of houses, divided by the number of people resident in the area.

What did we find?

Estates developed in the 1980s and 1990s

Many of the older estates have followed a predictable suburb-lifecycle, with an increase in older small households over time, and developing similar age structures found in older suburban areas. In the samples of estates developed during the 19080s and 1990s, a proportion of people who moved in to an estate during its development phase will remain in that estate and age in place.

Nonetheless, these estates continue to attract family groups with young children, which is not surprising given the predominance of family-type housing. When a house is sold, it is generally accesses by younger families. In this way these estates are continually regenerating, maintaining a need for a range of services aimed at early childhood to older persons. This occurs as a house is placed for sale and an existing household moves out, as opposed to there being further development. Estates do not generally attract young adults or retirees (except for retirement villages).

Estates marketed as affordable

Estates marketed towards the affordable end of the market, are less likely to retain people as they age in place; instead when people move out, they attract young first-time homebuyers unable to afford elsewhere and maintain a much younger age profile. These estates have an ongoing large population of young families and a lower proportion of older families and retirees than other estates of comparable age.

There is a risk with areas specifically targeted for the cheaper end of the market that they are likely to become areas with higher rates of disadvantage, attracting those households unable to afford elsewhere. There tends to be a higher turnover of population in these areas, because people able to access sufficient funding are more likely to move away from the area. Of concern is the fact that the more affordable estates tend to have a residual ageing population who do not have the resources to seek other alternative housing. Land values in such areas are likely to be more depressed, promoting a negative feedback loop – with people able to move out, leaving a residual ageing population who are trapped because they have insufficient resources and land values to downsize elsewhere. Such areas risk producing undesirable concentrations of socio-economic disadvantage.

The emergence of higher density offerings

Affordability is driving housing diversity on estates and this is most apparent in those estates developed post 2011. Where medium density dwellings are developed, they are attracting the same market as has been traditionally been attracted to greenfield development. As land values increase, then first-time homebuyers are increasingly accessing medium and higher densities within greenfield, whereas the traditional detached houses at densities of 12 to 15 dwellings per hectare are attracting people who are already on the housing ladder. Although beyond the scope of this study, it is also observed that the estates marketed as ‘more affordable’ often have smaller lots and are achieving higher densities than historically.

Average household size

Average household size is also broadly reflective of economic considerations, with average household size increasing overtime in estates developed in the 1980s and 1990s. Even though these are communities with a growing proportion of older and smaller households, average household size in all estates developed or developing at 2006 have increased from 3.26 to 3.39 persons per household, which goes contrary to expectations. Given that greenfield sites attract and continue to attract family households, it can be expected that average household size would remain relatively high; but the estates reviewed generally showed an increase over the period – most clearly in NSW and Victoria, and to a much lesser extent in WA. The implication, given the greater proportion of older persons overtime, is that people are staying at home a lot longer, and it can be assumed that one of the main drivers is affordability.

Interested in how greenfield estates in your area have developed? Access our local government area information tools here.

.png)