The 2015-16 Federal Budget has now been handed down. Budget Paper 1 provides a treasure trove of economic analysis and forecasts of the Australian economy. Let’s synthesize the main points of interest for local government decision makers.

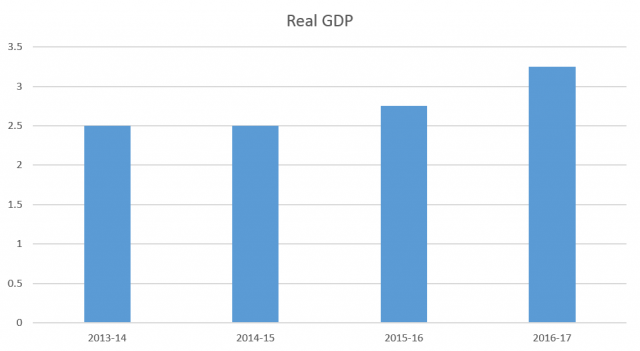

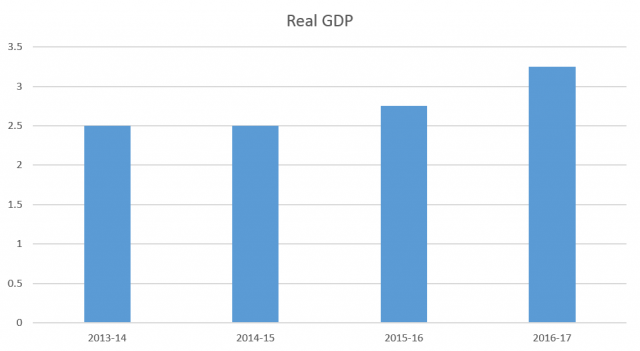

The key budget forecast is that economic conditions at the national level are expected to remain soft in the short term before a medium term pick up. The forecasts highlight that businesses and consumers are still taking a cautious approach to investment and spending.

See .id’s National Economic Indicators Series if you are interested in seeing how your local economy compares to this level of economic growth. The National Economic Indicators Series is a set of key economic measures for every Local Government Area (LGA) in Australia.

For local governments, this pause in economic activity provides some breathing room to prepare strategies that can position each local economy to take advantage of the next wave of growth.

The budget also provides a few hints to the next wave of growth. Understanding how your local economy could respond to these drivers should be a key focus of economic development strategies. We have provided a brief summary below on some of the drivers of growth presented in the budget.

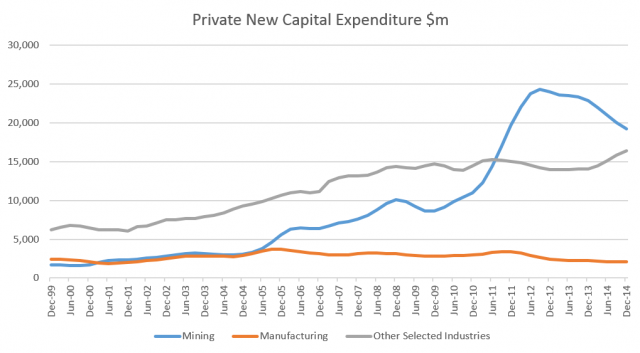

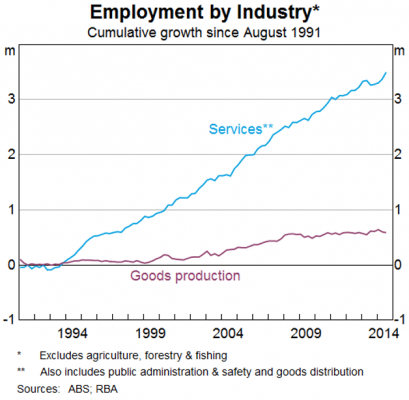

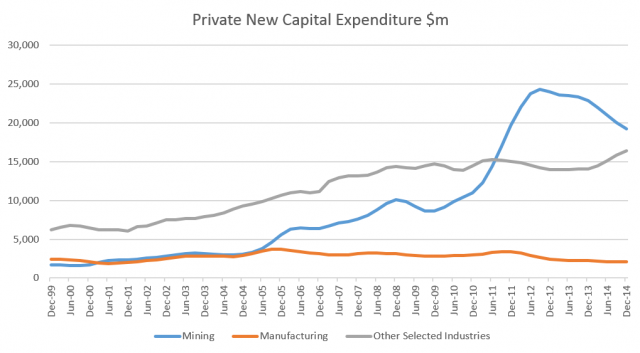

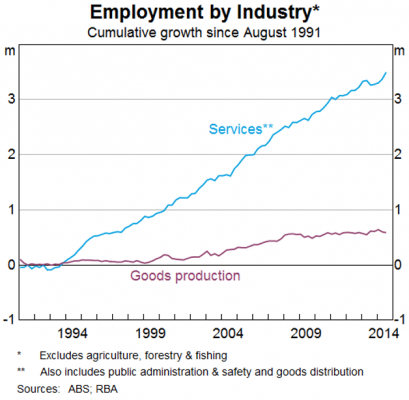

Economic pick-up will be driven largely non-mining investment (service sector) and improved global economic conditions

- But will need to wait on improvements to business confidence.

- Small business package aimed at increasing capex spend leading to improved retail conditions and then helping overall business confidence.

- Limited infrastructure spend though means low interest rates still required to help confidence.

- But remember, non-mining investment growth is more employment intensive compared to the mining investment phase – should see strong employment growth once business confidence turns around. Retail employment will be a lead indicator.

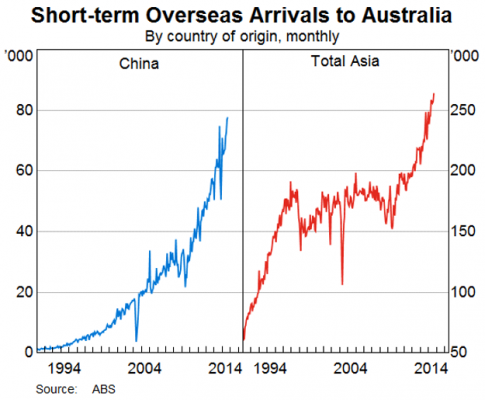

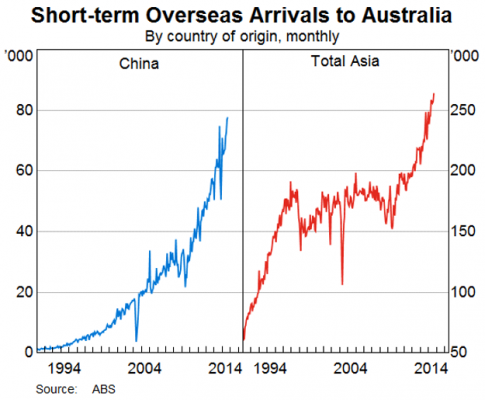

Not just about China. Think about India as well

- This prosperity is set to drive expenditure on higher value products and services. These powerful changes will present significant opportunities for Australia’s industries

- Big opportunities for education, agriculture/food, energy and tourism.

Economic performance and business competitiveness will be further assisted by a lower exchange rate

- Should further help export growth in tourism and education.

- China overseas visitor arrivals reached 760,000 in 2013-14, spending around $6.5 billion. Great news for local retailers, food and accommodation.

- Should also help manufacturing export volumes, particularly medium‑to‑high skilled and technology‑intensive goods such as pharmaceuticals, professional and scientific equipment, and machinery and transport equipment.

LNG will diversify our energy exports

- By the end of the decade, Australia is set to overtake Qatar as the largest exporter of liquefied natural gas (LNG) in the world. Good news for WA, QLD and NT.

Package to help Small Businesses

- Small business package (lowered tax burden, tax deductions, reduced red tape) should help growth in small businesses.

- First impact is likely to be stronger retail sales as businesses invest in new tools and machinery.

- This could help kick start overall business confidence with improvements in retail trade figures.

Agriculture likely to benefit

- Agriculture will benefit with new funding aimed to facilitate investment in northern Australia and a response to the ongoing drought in many parts of the country.

Infrastructure pipeline

- Robust pipeline when combined with already announced projects.

- Victoria’s expenditure looks light on a per capita basis, particularly if East West Link is excluded.

| Project |

Value $m |

| New South Wales |

11,292 |

| Western Sydney Infrastructure Plan |

2,900 |

| Pacific Highway duplication |

5,600 |

| WestConnex: |

1,500 |

| Northern Sydney Freight Corridor |

691 |

| NorthConnex |

405 |

| M1 Productivity Package |

196 |

| Victoria |

4,248 |

| Western Highway—Ballarat to Stawell Duplication: |

501 |

| Tullamarine Freeway Widening (Section 1) |

200 |

| Princes Highway West—Winchelsea to Colac Duplication |

186 |

| St Albans Road Rail Level Crossing |

151 |

| Princes Highway East—Traralgon to Sale Duplication: |

210 |

| East West Link |

3,000 |

| Queensland |

10,149 |

| Bruce Highway |

6,700 |

| Gateway Motorway North |

930 |

| Toowoomba Second Range Crossing |

1,285 |

| Warrego Highway |

508 |

| Cape York Region Package |

208 |

| Moreton Bay Rail Link: |

518 |

| Western Australia |

3,336 |

| Perth Freight Link |

925 |

| Gateway WA Perth Airport |

675 |

| NorthLink WA—Swan Valley Bypass |

615 |

| NorthLink WA—Tonkin Highway Grade Separation |

141 |

| Great Northern Highway (Muchea to Wubin): |

308 |

| North West Coastal Highway (Minilya to Barradale) |

173 |

| Other |

499 |

| South Australia |

1,029 |

| North-South Corridor—Darlington interchange |

496 |

| North-South Corridor—Torrens Road to River Torrens |

448 |

| Anangu Pitjantjatjara Yankunytjatjara (APY) Lands: |

85 |

| Tasmania |

486 |

| Midland Highway: |

400 |

| Freight Rail Revitalisation: |

60 |

| Brooker Highway (Elwick-Goodwood to Howard Road): |

26 |

| Northern Territory |

237 |

| Northern Territory Roads Package |

77 |

| Regional Roads Productivity Package |

90 |

| Tiger Brennan Drive Duplication (Dinah Beach Road to Berrimah Road) |

70 |

| Australian Capital Territory |

111 |

| Majura Parkway |

111 |

| TOTAL |

30,888 |

National Stronger Regional Fund

Local councils and incorporated not-for-profit organisations can now apply for funding of between $20,000 and $10 million for capital infrastructure projects under Round Two of the $1 billion NSRF.

- Provided for capital projects which involve the construction of new infrastructure, or the upgrade or an extension of existing infrastructure.

- Projects must demonstrate strong economic outcomes and support disadvantaged regions

- Successful round 1 projects included research and industrial hubs, art centres, community facilities, improved connections and infrastructure.

.id are working with a number of councils to assist with completing their application, including a full application service, peer review, help running the impact assessment model or tailored advice. Let us know if you’d like

And remember, applications must be submitted by 5.00pm local time on Friday, 31 July 2015.