The Federal and Victorian Governments recently announced a $230 million bailout for Alcoa, a large Aluminium smelter based in the western Victorian town of Portland. The smelter has come under recent costs pressures due to changes to a long-term energy subsidy contract and a power outage that caused considerable damage to equipment last year. The bailout has reportedly secured ongoing operations and the 600-700 jobs at the plant for another four years. Read some media coverage here.

Whenever a case like this hits the media, the public often asks – is such a huge taxpayer funded bailout worth the saving of the number of jobs in question? (as with Automotive industry discussions). Of course, what is overlooked is that the money is not just supporting the plant’s direct jobs but also a multitude of flow on jobs that are a result of supply chain businesses and consumption expenditure from all those workers. The Glenelg Shire, where Portland is located, have recently subscribed to .id’s economic profile tool economy.id, so this gives us the great opportunity to model just how much impact the closure of Aluminium smelting would have in the broader region.

The importance of Metal Manufacturing to the Glenelg Shire

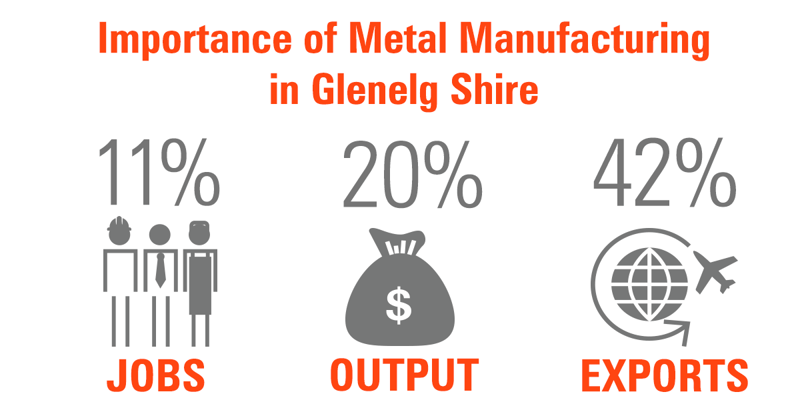

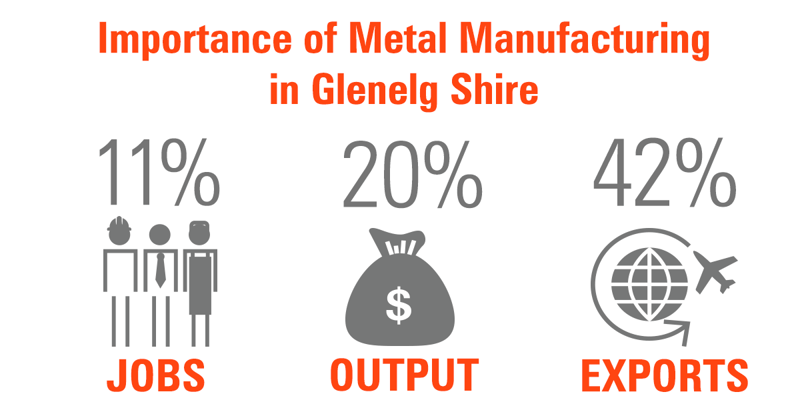

Firstly, we can start by exploring how important the industry currently is. In 2014/15, it is estimated that Primary Metal and Metal Product Manufacturing (ANZSIC industry title which would include aluminium smelting) generates 605 jobs in the Glenelg Shire with a further 329 jobs in Fabricated Metal Product Manufacturing (which would largely be connected with the smelting works operations). Together these 934 jobs represent 11% of all jobs in the Glenelg Shire and a very large 73% of all manufacturing jobs.

The two industries combined are also key generators of output and exports for the economy. In 2014/15, they generated $325m in output (20% of the whole of Glenelg Shire output) and $314m in exports (42% of total exports). The share of exports is particularly important as exports bring external earnings into the local area. By doing so, exports increase demand for local services through multiplier effects, creating a virtuous cycle of economic growth. This means the economy can grow without the constraint of population and local market limits.

So what if Alcoa closes?

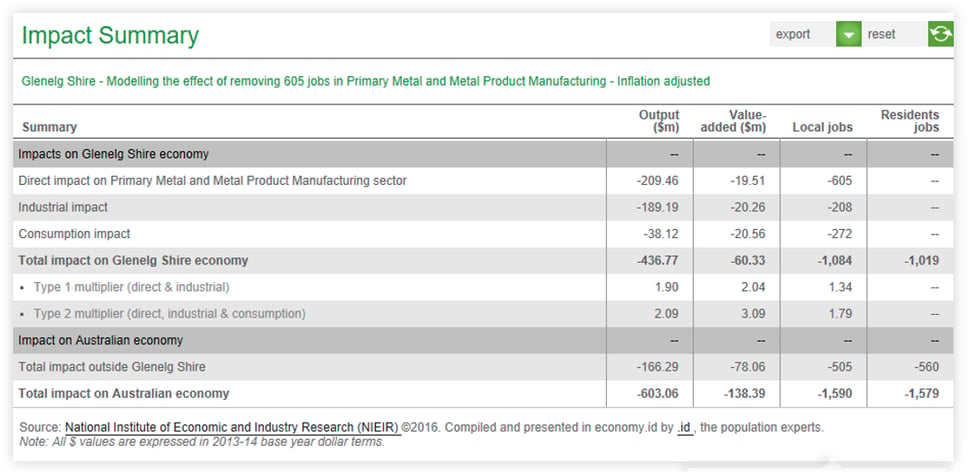

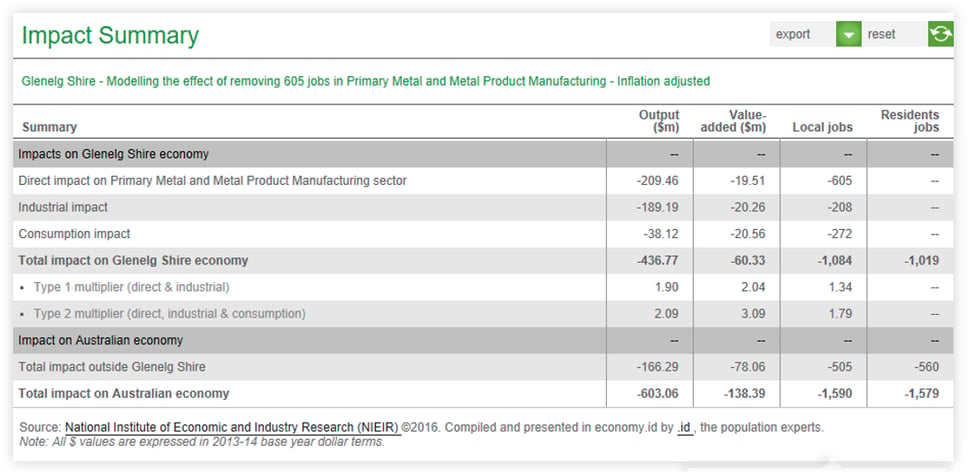

To explore the true impact of the closure of Portland’s Aluminium smelting plant we cannot simply look at the direct impacts. As previously noted, the smelter’s operations support a huge number of flow on jobs and economic value. This is where we can use economy.id’s Economic Impact Model to explore the impacts of removing 605 jobs from the Primary Metal and Metal Product Manufacturing industry in Glenelg. The model can be used as an estimate of the impacts of removing jobs by placing a negative number in the input value. As the table shows the true value of these workers to the Glenelg Shire each year is some $60.3m, and their work and incomes support another 480 jobs in the community making a total impact of 1,084 jobs.

If we add to this figure, the direct and flow on impacts of removing 329 jobs in Fabricated Metal Product Manufacturing ($81m value add and 689 jobs) we get a combined estimate of $141m in value added and 1,773 jobs. Even allowing for some double counting due to the assumed supply chain relationship between these industries, we can see that the multiplied impacts of the smelter closing would be over $100m in value-added and likely around 1,500 workers (including direct and consumption impacts only).

However, this is not the end of it. The deep water port of Portland generates considerable value from the import and export of the smelter’s inputs and ingot production. In 2015, trade in smelter products accounted for 13% of the Port’s annual tonnage. If the smelter closed, the Port’s operations would likely have to be reorganised possibly resulting in increased costs for the other industries that utilize it. In the case of Portland this is predominately the timber industry.

Additional benefits?

As shown in the economic impact model, the Primary Metal and Metal Products Manufacturing industry also generates large impacts outside of the Glenelg Shire. In fact, it is estimated to contribute to the rest of the Australian economy more than double the value added generated within the Shire and an additional 505 jobs.

Alcoa has also stated that they inject some $395m into Australian Government coffers are various levels as the result of royalties, taxes, rates and charges. See Portland Aluminium Smelter fact sheet for more information. A wider economic benefit analysis might also take into account the self-reported $1m p.a. in local sponsorship and 7,000 hours of volunteerism by employees.

So is the bailout good value for investment?

Based on the quick analysis we have done, it would appear that $230 million over four years isn’t that bad an investment, or at least not as alarming as might have been first considered.

However, things are always more complicated than they seem. A true analysis would also consider the costs of bailing out the smelter. Its operations still rely on using some 10% of Victoria’s electricity. This, combined with the plants general production methods, contributes vast amounts to the state’s carbon emissions. The impacts on the environment are immense and, in addition, a return to a price on carbon would surely eat into the plant’s profit margins.

The reliance on electricity also draws into question what the impacts on the energy market would be with the closure. The cease of operations at the company’s Point Henry smelter in 2014 was estimated to take 350 megawatts (or just over 5%) from the Victorian market, severely impacting the balance sheet of power plants in nearby Anglesea (which subsequently closed) and the Latrobe Valley.

Also, what happens in four years’ time after the deal negotiated by Alcoa, the two governments and the new energy provider AGL finishes?

One thing that is certain is that the Shire and community probably won’t rest on their laurels and are likely working to address ongoing economic transition challenges similar to other regions. The economy has seen strong growth in Agriculture over recent years and the strategic planning for the Green Triangle Region is already identifying and supporting new opportunities (especially blue gum hardwood exports).

You can explore more about the Glenelg Shire’s economy here.

.id is a team of demographers, urban economists, spatial planners and data experts who use a unique combination of online tools and consulting to help governments and organisations understand their local economies. Access our free economic resources to help profile your local economy.