I recently wrote about Australia’s economic transformation to services and knowledge intensive activities (see here). Alongside this trend has been a steady decline in overall manufacturing jobs. But the typical ‘doom and gloom’ story for the national manufacturing industry, hides the good news stories that can be found at a local level, in our towns and regions.

Is manufacturing in decline in your region, or is it bucking the national trend?

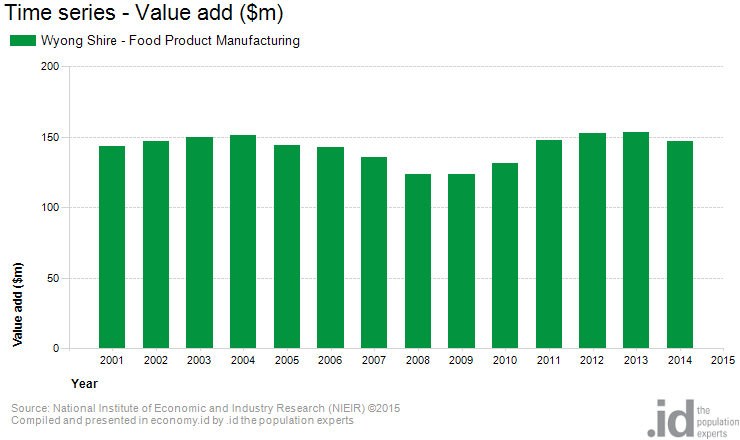

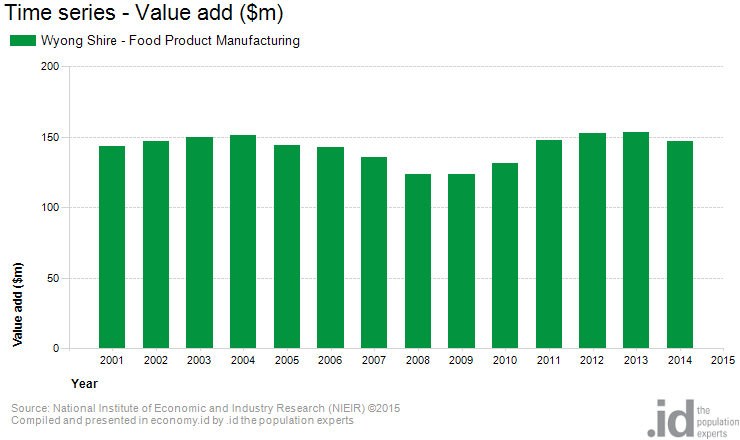

The Food Product Manufacturing sector in Wyong Shire, on the Central Coast of NSW, is an example of a local economy bucking a national trend. At a recent presentation to the team at Wyong Shire Council, I highlighted the re-emergence of Food Product Manufacturing over the past few years. While employment conditions in Wyong Shire have been generally soft, Food Product Manufacturing is on the rise, both in employment and value added terms, as you can see in the two charts below. A bit different to the typical ‘manufacturing is declining’ headline.

What makes Wyong unique?

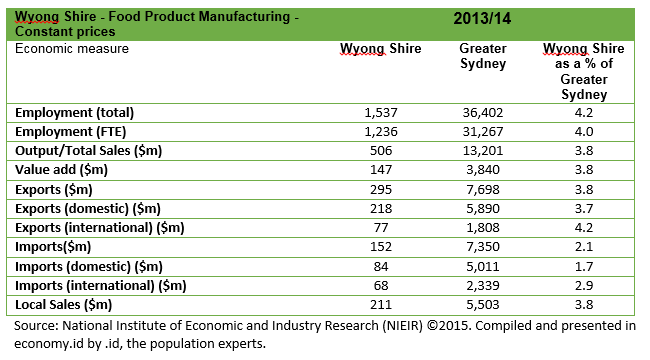

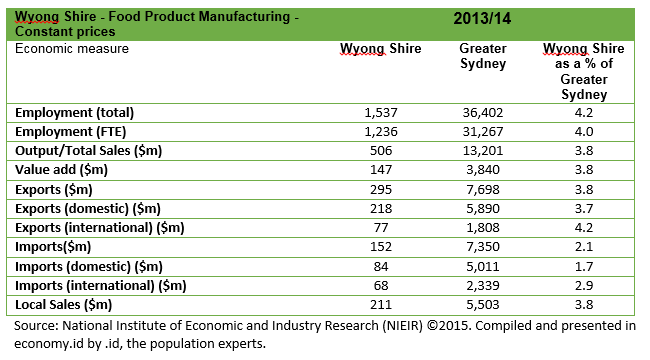

The Food Product Manufacturing sector contributes 1,537 jobs (3.0%) to total employment in Wyong Shire. The sector contributes $147.11 million and is an important exporter to both domestic and international markets. The main food product manufacturing activities in Wyong Shire include Grain Mill and Cereal Product Manufacturing and Fruit and Vegetable Processing.

While Food Product Manufacturing makes up a relatively small share of total employment, it is highly specialised in Wyong Shire with a location quotient of 1.84 compared to NSW. A location quotient of greater than 1.2 is generally considered a level of industry specialisation or over-representation. The Structure > Employment (Total) page in economy.id allows you to look at location quotients by industry and industry sectors.

So what is driving the re-emergence of Food Product Manufacturing in Wyong Shire? The workshop discussion with Wyong Shire Council revealed that Life Health Foods Australia opened a 6,000sqm factory in Berkeley Vale, Wyong, encompassing frozen, chilled and canning technologies. A bit more digging around showed that another factory – The Cordina Food Co – opened its doors in 2014 (with assistance from the NSW Government’s Regional Industries Investment Fund). According to an interview with Louise Cordina, this location in Wyong Shire has enabled them to better position its partners to deliver on changing consumer trends (read the article here).

This local knowledge and evidence from economy.id provides an important platform for developing economic strategies to unlock the potential of food product manufacturing in Wyong Shire.

Global opportunities for Australian manufacturers

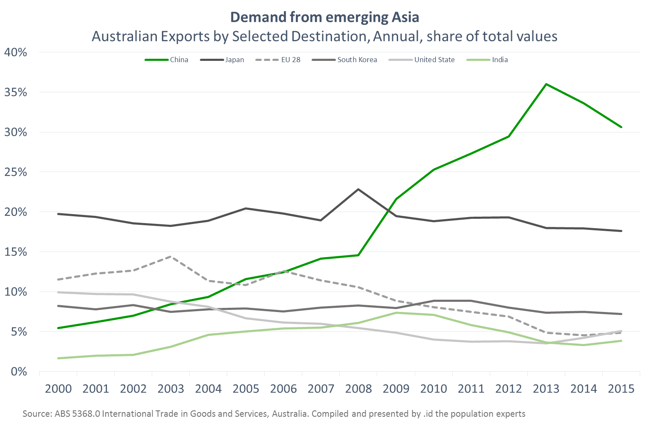

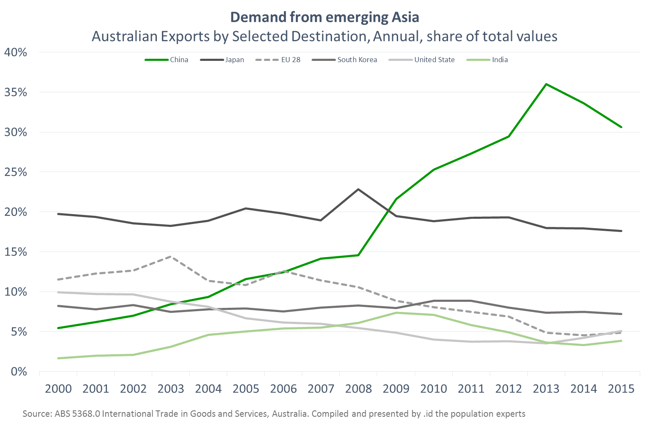

This is particularly important given the opportunities emerging from the shift in Australia’s trade and export patterns towards Asia. The recently completed free trade agreements should also provide new export opportunities for Australian businesses.

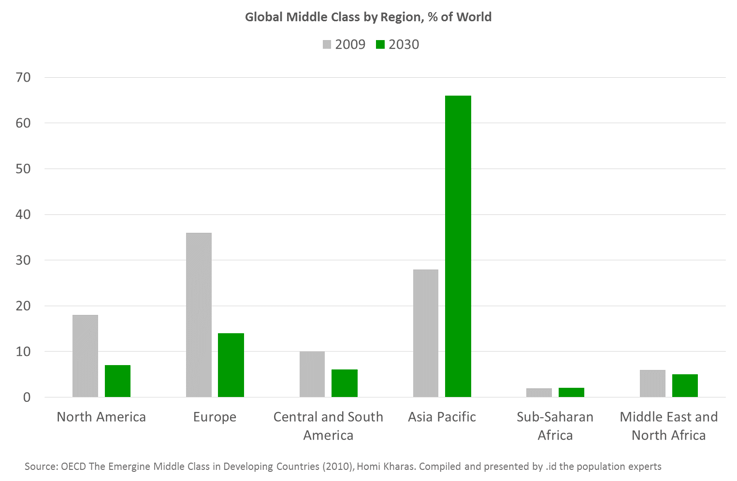

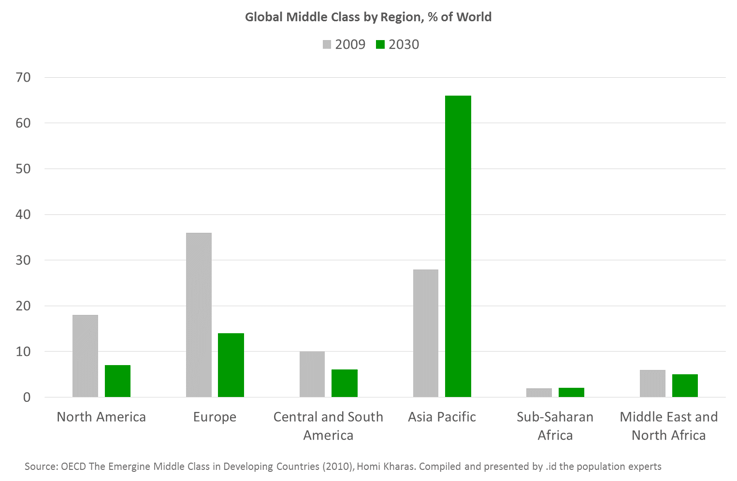

The industrialisation and urbanisation in Asia are generating rising income levels and growing the size of the middle class. Asia Pacific middle class is expected to account for 66% of the global middle class by 2030, up from 28% in 2009. This prosperity is set to drive expenditure on Australia’s higher value products and services.

A larger middle class will increase demand for food and create new export opportunities for the Australian food industry including places like Wyong Shire that can build a competitive advantage or niche product offer.

It’s important to be strategic

Of course, the manufacturing industry is still facing many challenges; probably more than ever before. But we also need to identify the opportunities and then support these with economic development initiatives. This will require a strategic approach to innovation, productivity, skills, supply chain development, export markets, infrastructure and promotion.

Is manufacturing declining in your region, or is it bucking the trend? If you’re council subscribes to economy.id, you can investigate for yourself here.

.png)