Employment clusters are becoming more and more important as Australia shifts towards an economy based on skills, ideas and connections. But where are they? How are they changing? And how can we help them get established?

Emergence of employment clusters

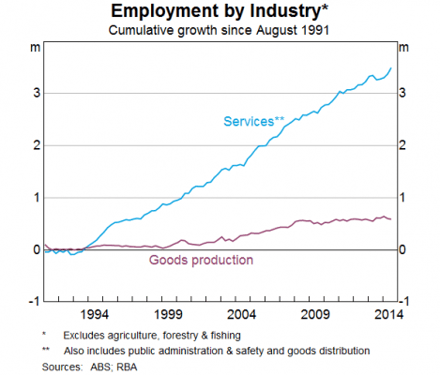

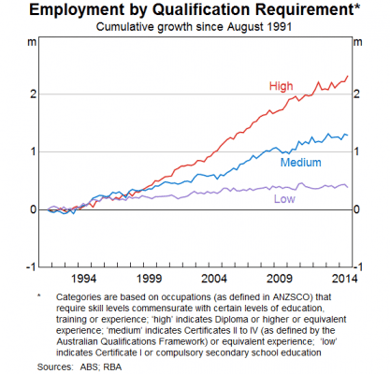

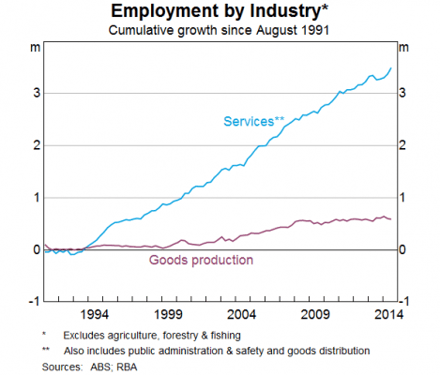

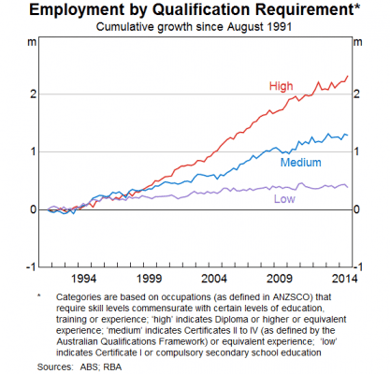

Australia’s economic transformation to services and knowledge intensive activities is having major implications for the economic development of our local areas. The majority of the new jobs have been in services. According to the RBA, over 3½ million service industry jobs have been created since the early 1990s. Our economy is also becoming more dependent on ideas and problem solving, with the largest increase in jobs being those that require higher level qualifications.

Demand for businesses seeking to co-locate or cluster with other businesses has been driven largely by the importance of services and ideas. Businesses in clusters can benefit from access to large labour force pools, enjoy a wider range of services and amenities and share ideas. But we need to nurture these precincts to maximise this potential.

The CBDs

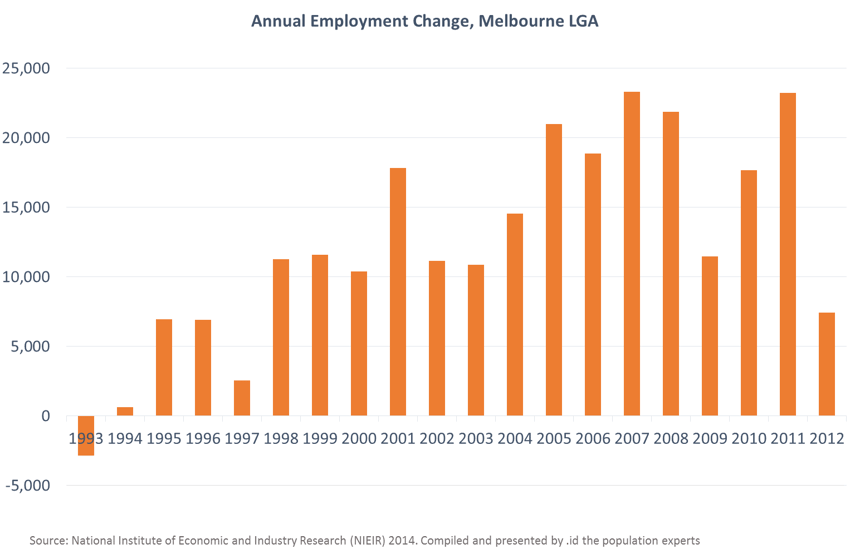

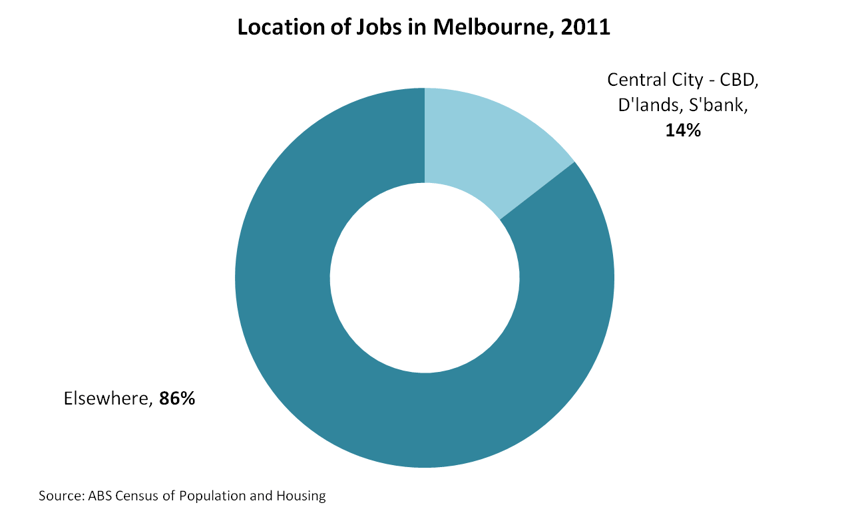

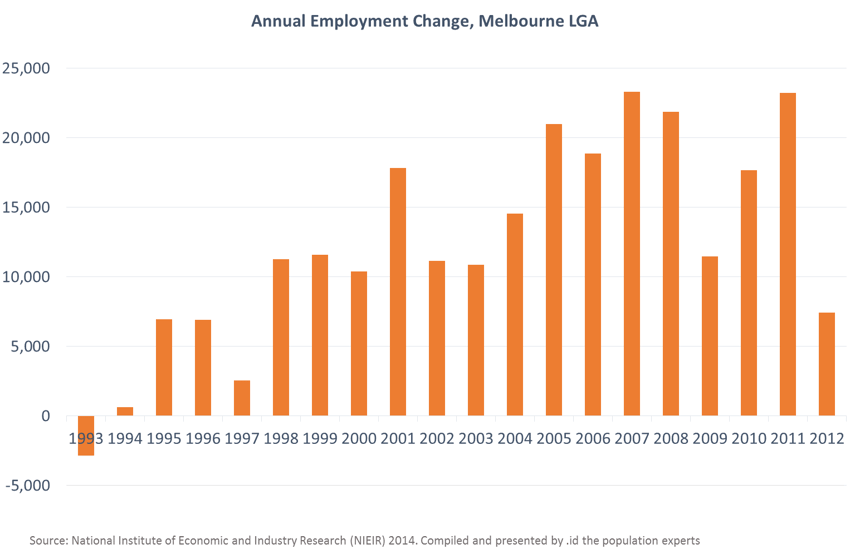

Traditionally, investment for service sector employment growth has focussed on CBDs, with CBDs the focus for major transport projects, investment attraction efforts, more flexible planning and provision of major attractors. This is clearly evident in the Melbourne LGA.

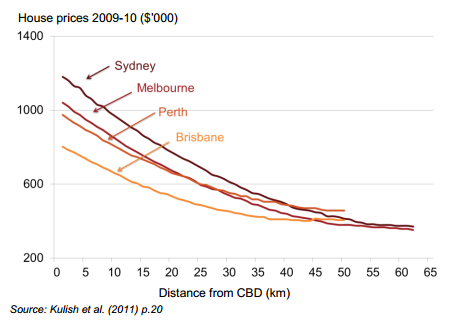

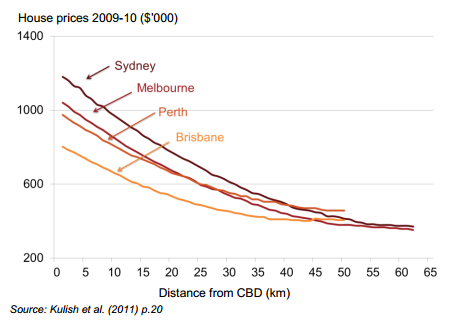

However, the rapid expansion of the service sector has come with a cost; with implications for productivity, housing costs, wealth distribution and liveability (we will look at this another time).

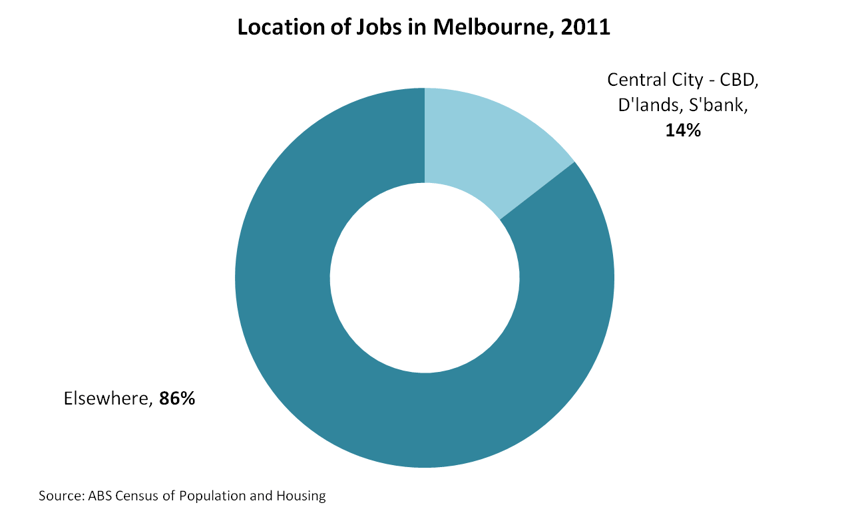

It is also worth noting that while economic activity is concentrating in CBDs, the majority of jobs are still located in the suburbs and a large share of future employment growth is suburban based.

Given the dispersed nature of suburban employment historically, the trick is in influencing the location of future suburban employment growth. However, many suburban locations are not well equipped to leverage off the opportunities from the service sector economy. This is due to a range of issues including a manufacturing past with different transport needs (efficient access vs high amenity), tight regulatory controls, transport deficiencies and amenity.

We need to think about our non-CBD employment precincts

To take advantage of the opportunities presented by the service sector economy and higher skilled jobs, we need to unlock the potential of our clusters by developing local area strategies and move beyond traditional activity centre or retail approaches. These strategies should be informed by a detailed understanding of the economic, employment and place fundamentals of the employment cluster. An employment precinct profile can help local councils to:

- Understand key performance indicators on employment clusters / precincts to support business growth, innovation and policy.

- Identify opportunities to leverage off competitive advantages.

- Help shape economic development, investment attraction and strategic planning.

- Monitor performance by establishing baseline indicators.

An example – Norwest Business Park

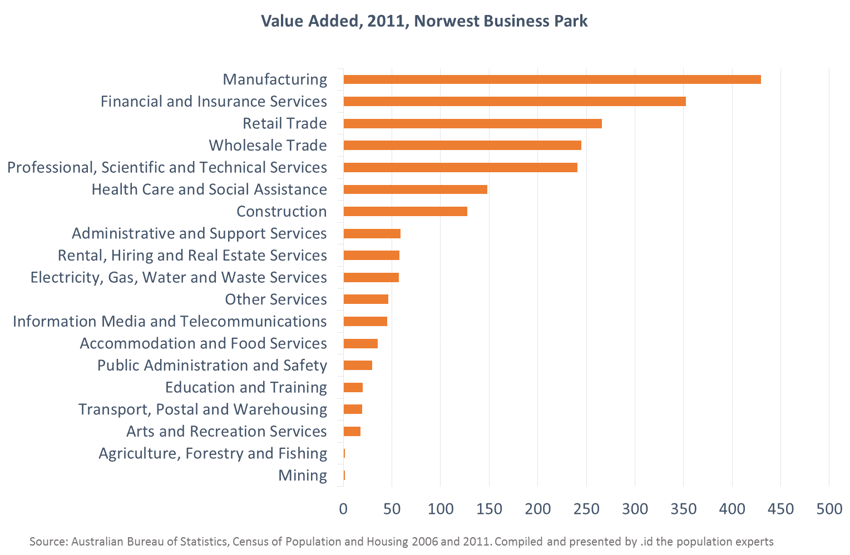

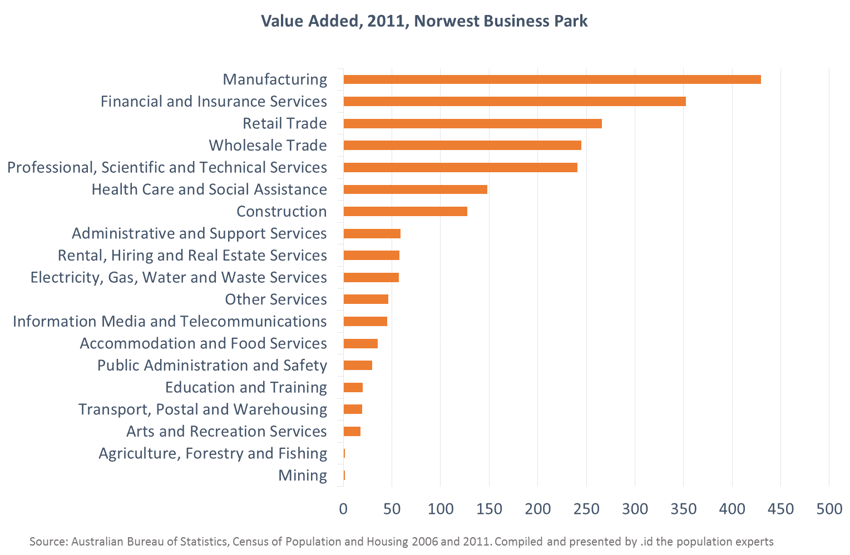

Norwest Business Park is located in The Hills, Sydney, 36 kilometres from Sydney’s CBD. In 2011, Norwest Business Park accommodated 17,590 jobs with an economic value of $1.9 billion. Key employers are retail, manufacturing, financial and professional services and health.

.png?width=720&height=513&name=Norwest-industries-2%20(1).png)

There is a strong pipeline of non-residential building activity with over $90 million of projects in the pipeline. This includes major health and short term accommodation buildings.

The future looks bright for the Norwest Business Park with the construction of Bella Vista station, located on the Western edge of the precinct. The provision of a station is likely to have a range of positive impacts for the Norwest Business Park including employment growth, residential take up rates, property values and diversification of the business base, providing it with the potential to attract national/international tenants. The strong link between economic output and capital stock is clearly identified by National Economics recent State of the Regions report.

.png?width=850&height=583&name=increase-in-GRP%20(1).png)

Source: State of the Regions 20145-15, National Institute of Economic and Industry Research (NIEIR)

Take-outs – strategies for cluster-led development

1. Leverage off anchor institutions as key economic and community drivers.

2. Complementary Transport- Changing the debate about roads from focusing on alleviating congestion to investing in transport for jobs

3. Placed based strategies – Many suburban locations are not well equipped today to leverage off the opportunities from the service sector economy. Investment could include amenity, recreation, public transport provision, accessibility improvements, public realm improvements and planning controls.

4. Making the most of traditional advantages – who are the star economic performers locally? How do we maximise their potential?

5. Urban Renewal – integrated housing strategies – There is a risk that escalating house prices will reduce the level of labour supply available.

.png?width=720&height=513&name=Norwest-industries-2%20(1).png)

.png?width=850&height=583&name=increase-in-GRP%20(1).png)