We’ve all read about it. A glut/oversupply/huge peak of apartments coming through in Melbourne. Is it happening? Where is it happening?

Well, by happy coincidence, .id has recently completed population and housing forecasts for the Local Government Areas (LGAs) of Melbourne, Yarra, Port Phillip and Stonnington, giving a unique opportunity to assess the current status of the inner Melbourne housing market. A key element of .id’s forecasts for local government is assessing what has happened since the 2011 Census and what is likely to occur each year out to 2036. In the current period, this involves assessing all housing projects over 10 dwellings and forecasting when they are likely to be constructed. Countless hours are spent poring over up to date aerial photography looking for signs that a development has commenced construction and assessing when the apartments are likely to be finished.

The result of all this? Yes, an unprecedented number of apartments are now under construction in the inner Melbourne LGAs of Melbourne, Yarra, Port Phillip and Stonnington. These of course are the LGAs that we have recently completed forecasts for. Maribyrnong (Footscray area) and Moreland (Brunswick area) are also experiencing a significant number of apartment projects currently under construction, so the numbers below actually understate the level of inner city apartment development occurring.

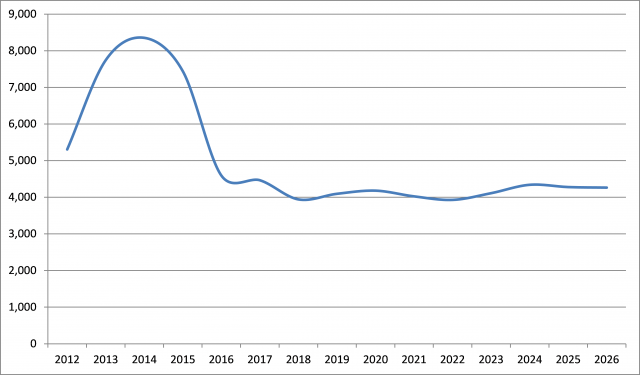

The chart below shows assumed number of dwellings completed each financial year to 2026 in the LGAs of Melbourne, Yarra, Port Phillip and Stonnington. In the 2 years ending 2015, over 15,000 dwellings are expected to be completed in the 4 LGAs.

.id Council forecasts – net change in dwellings 2012-2026 – Cities of Melbourne, Yarra, Port Phillip and Stonnington

To provide some context, these four LGAs added 19,600 dwellings in the five year period between 2006 and 2011.

How is this arrived at? Aerial photography has been studiously reviewed to assess the construction status of each major project. Councils provide great assistance here, providing us with information about each approved and upcoming project. Based on our review of these sites, we estimate that there are somewhere between 9,000 and 10,000 apartments currently under construction in the four LGAs, the majority of which we estimate to be completed by the 2014-15 financial year. Major hotspots of development include Melbourne CBD, Southbank, Richmond, Abbotsford, St Kilda Road and South Yarra.

What does this mean for forecasting?

Such a large spike of apartment development has implications for how we forecast population. Assumptions on net change in dwelling stock each year feed into our forecasting model by updating our dwelling stock. However we also make assumptions about what proportion of dwellings are vacant, or vacancy rates. Just to add more complexity, we also undertake forecasts of persons in non-private dwellings; this is institutional population, comprising such facilities as nursing homes, boarding schools, military bases, boarding houses, hospitals, prisons and also importantly in the inner city, serviced apartments.

It is probably too early to tell exactly what the impact will be of the peak in apartment construction. There are a number of things that could happen; firstly, many apartments may not be able to be tenanted, thereby increasing the vacancy rate. Secondly, owners may decide to use their apartments as serviced apartments for a certain period of time until there is enough demand to absorb the new supply. This second option technically removes the apartment from the dwelling stock as non-private dwellings are not counted. Indeed it is conceivable that apartments assumed to be constructed in latest set of forecasts are removed in the next set of forecasts when they are being used as serviced apartments.

The issue of short stay apartments in inner areas also muddies the waters as they may be classified as private dwellings, but would not contain usual resident population (the population we are forecasting as part of the estimated resident population). These apartments may indeed be occupied on most nights with short stay visitors, but would effectively be classified as vacant in our forecasts.

The next couple of years will give us a better indication of the likely take up and use of these new apartments and answer some of these questions. Two things are certain, there is a large spike of apartments coming through and secondly, population forecasting in the inner areas of Melbourne has got even more challenging than before!

For more information about population forecasting, subscribe to our newsletter or visit our website. You may also wish to speak to one of our amazing population forecasters here!