The recent dip in house prices has implications for local economic development, particularly in our largest cities, says .id’s Senior Urban Economist, Rob Hall.

Key points

- Falling house prices are likely to impact some local economies more than others

- This is because falling house prices are linked to household wealth. Local economies that rely on discretionary spending are likely to be most at risk.

- How you can assess the risk of falling house prices in your LGA (eg. reliance on Retail Trade industry)

- We’ve updated economy.id with 2017/18 economic data

More from Rob Hall

What’s going on here?

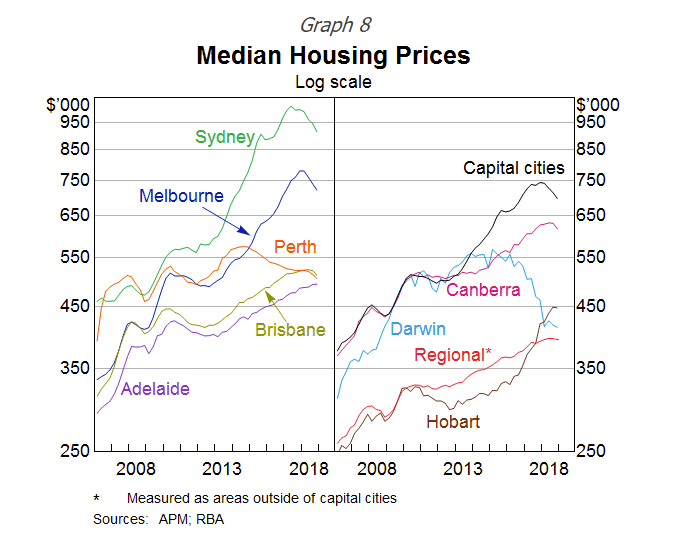

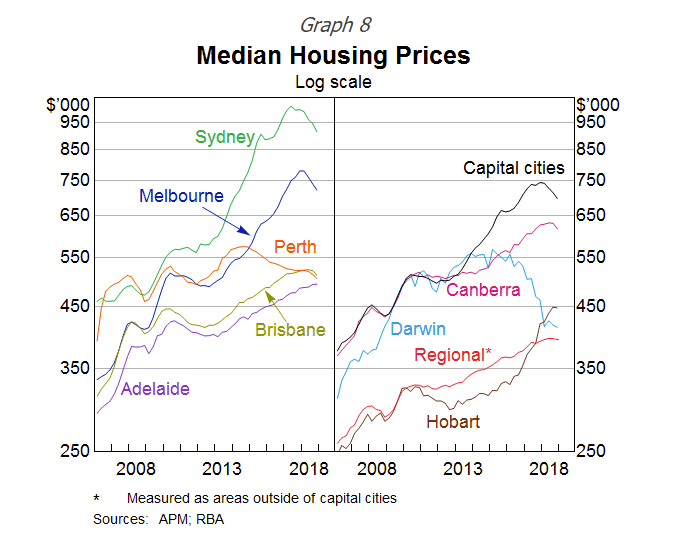

Much has been said recently about the fall in house prices across Australia, especially in our two largest cities of Melbourne and Sydney. Housing prices fell by 9.7% in Sydney over the year (ended in January), and 8.3% in Melbourne. But in saying this, prices are still considerably higher than five years ago.

What does this mean?

From an economic development perspective, the important question is not ‘how much will housing prices fall?’ but ‘what impact will this have on my local economy?’.

At this stage, the housing price falls have not corresponded with rising unemployment, although underemployment is still high. But if wages remain flat (and global economic growth slows further) then at some point falling wealth is likely to have a negative impact on household consumption.

Last week I came across a chart from the RBA that shows the link between housing wealth and consumption. This chart (below) shows that an increase in wealth is associated with an increase in consumption. Sectors most impacted from changes in wealth include vehicle sales, furnishings, clothing, utilities and recreation. For example, a 1 per cent increase in per capita housing wealth is estimated by the RBA to lift vehicle sales consumption by 30%.

(You can check out the full RBA presentation here)

Why should Local Government care?

So, if the relationship holds for when housing prices fall, which areas of Australia are likely to be most impacted?

At the regional level, we expect that the impact on household consumption is likely to be most significant in Sydney and Melbourne, as housing prices in other capital cities and regional areas remain largely stable. Within Sydney and Melbourne, we expect that areas with a high reliance on discretionary spending (e.g. high share of output in Retail Trade and Arts and Recreation) are likely to be at most risk.

Therefore, we encourage economic development practitioners to look at strategies to diversify their local economy. This is because a diversified economy is generally more resilient than a concentrated one, as declines in say Retail Trade (due to house price falls) can be compensated by growth in others (e.g. manufacturing which may get a bump from a more competitive (lower) exchange rate).

How do I identify the high-value industries in my area?

If you’re an economic development officer, you may wish to run through this guide for identifying high-value local industries in your area.

See the data for your area: open our network of 140+ local economic profiles here.

How is your region performing?

We have recently released our annual update to economy.id – our publicly-available network of over 140 local economic profiles. This update adds the latest economic data for 2017/18 at the Local Government Area level.

This data helps councils, regional authorities and the wider Australian community monitor how their economies are performing. This information can be used to check if your LGA is at risk from falling housing prices.

The key health check metrics that we would be looking at are:

- % employment in Retail Trade (especially motor vehicle sales and other-store retailing)

- % of employment in Arts and Recreation

- House price change

The following video shows you how to find those key indicators in the economic profile for your LGA.

Need to know more?

Our consulting team are available to help our local government partners identify strategic local industries and develop economic development plans to attract investment and mitigate risks to important local industries.

To learn more about our consulting services or to discuss a project you’re working on currently, get in touch with our consulting team her