Peter Mares is a highly regarded journalist and broadcaster who has worked with .id previously when we have prepared housing studies for the Victorian Cities of Moreland and Moonee Valley. In this piece, Peter shares some perspective from his new book, No place like home, amid the current dip in housing prices and auction clearance rates.

When it comes to house prices, it seems we’re always on the brink of disaster. Last year a panicked media was full of stories about eye-watering prices keeping first home-buyers out of the market and dragging down rates of home ownership. Now public anxiety is focussed on falling property prices and fears of a long deep slump or even a crash.

It brings to mind the bush poet John O’Brien’s farmer Hanrahan who complains in the summer:

“If we don’t get three inches, man,

Or four to break this drought,

We’ll all be rooned,” said Hanrahan,

“Before the year is out.”

When rains do come, Hanrahan finds new cause for despair:

And every creek a banker ran,

And dams filled overtop;

“We’ll all be rooned,” said Hanrahan,

“If this rain doesn’t stop.”

Spring brings bumper crops and knee-deep grasses, but Hanrahan is still not happy.

“There’ll be bush-fires for sure, me man,

There will, without a doubt;

We’ll all be rooned,” said Hanrahan,

“Before the year is out.”

History might suggest that a real estate Hanrahan has solid grounds for concern. After all, Australia’s property market has been wracked by cycles of boom and bust, speculation and crash, since at least the 1880s.

This hardly seems the most sensible way to organise the essential good of decent housing that underpins and fair and productive society. Perhaps it’s time to ameliorate the extremes of the business cycle by changing the way we tax housing. Currently, the primary residence is a heavily protected tax shelter, which also makes it the primary store of wealth.

When home-owners make a capital gain, or pass on that gain to their children, the windfall goes completely untaxed. What is more, the value of a private residence has almost zero impact on the owner’s entitlement to government benefits, like the aged pension.

This encourages us to treat housing as a financial asset above its primary function in providing a home. It encourages us to over-invest in housing and, as a nation, take on dangerously high levels of household debt. It encourages us to use housing inefficiently. There are around 1.5 million more homes in Australia’s capital cities that have two spare bedrooms and 560,000 homes with three or more. Shifting from stamp duty to a broad-based property tax—as well as reforming negative gearing and the capital gains tax discount—could help ameliorate some of these problems. It could also help make housing fairer.

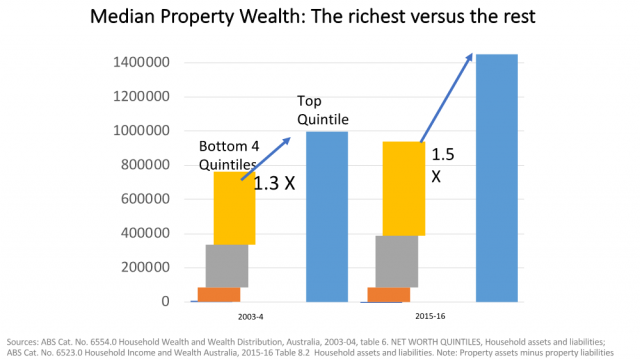

Current tax arrangements entrench inequality into bricks and mortar because the biggest benefits go to those who already have the most wealth and the highest incomes. As the chart shows, in 2004, the wealthiest twenty per cent of Australians owned property, that was worth, on average, 1.3 times the average property holdings of everyone else combined. In 2016, after a dozen years of rising prices, the average property holdings of wealthiest twenty per cent of Australians were worth 1.5 times the average property wealth of everyone else.

We have to hope that the Hanrahan’s of the property world are wrong and that we are not headed for a spectacular bust. As the Reserve Bank soberly told a parliamentary inquiry into home ownership “there are no examples internationally of large falls in nominal housing prices that have occurred other than through significant reduction in capacity to pay (e.g. recession and high unemployment)”. In other words, a crash in house prices will be accompanied by a crash in the economy and that would hurt the poor the most.

Equally, though, we should welcome recent moderate falls in house prices as a good thing even if they are liable to cause pain to some over-leveraged home owners and property investors. Overall, we stand to gain as a society if housing becomes more affordable. And the only thing worse than a real estate crash would be a return to the relentless prices rises of the past decade or more, because that would lead to an increasingly divided and unfair Australia, characterised by a growing gap between rich home owners and poor renters.

Peter Mares has worked with .id on housing reports for the cities of Moreland and Moonee Valley. His book, No Place Like Home: Repairing Australia’s Housing Crisis, is available now in bookshops or direct from Text publishing.