The ABS have been working overtime to produce statistical collections above and beyond their regular programs, in order to help us understand the impacts of Covid-19. Glenn gives us an overview of one important collection that’s been in the news this week – the Weekly Payroll Jobs and Wages, which gives us a look at how the virus has impacted different sectors in our economy.

Webinar | If you haven’t already, watch a recording of Monday’s webinar with our economist, Rob Hall, as he shares our early thinking on the impact of Covid-19 on our local economies.

As I previously mentioned, ABS are really ramping up their statistical collections at the moment to deal with the COVID-19 pandemic. It’s great to be able to get some timely data on specific macro-level trends. While the micro-level Census data which we mainly deal with is still very relevant and useful, it’s good to be able to get some perspective on exactly what is changing Australia-wide in a more timely way.

This document shows upcoming releases of smaller surveys specifically designed to measure the impacts of COVID-19 and the economic response.

In particular, one released on Tuesday (21/4) needs a shout-out: Weekly Payroll Jobs and Wages in Australia – First Release

It specifically looks at changes in jobs and wages/salaries in the period between March 14 and 4 April, representing the 3 weeks in which Australia went from having a few major events cancelled to most businesses closed, working from home and having only essential travel allowed.

It’s the first statistical release made available in such a timely manner as it accesses the ATO’s new online “Single Touch Payroll” system, which is now used in almost all larger businesses and a majority of smaller businesses. This dataset has the advantage of being more timely than a large survey and also less impacted by stimulus measures like the federal government’s Jobkeeper package – for this reason, the job losses shown shouldn’t be seen as an official unemployment rate, but they do give an insight into who is most heavily hit by this economic impact. It also allows a bit of state level data as well, which other surveys have been too small to support.

So what does it show?

I think this is the most interesting chart,

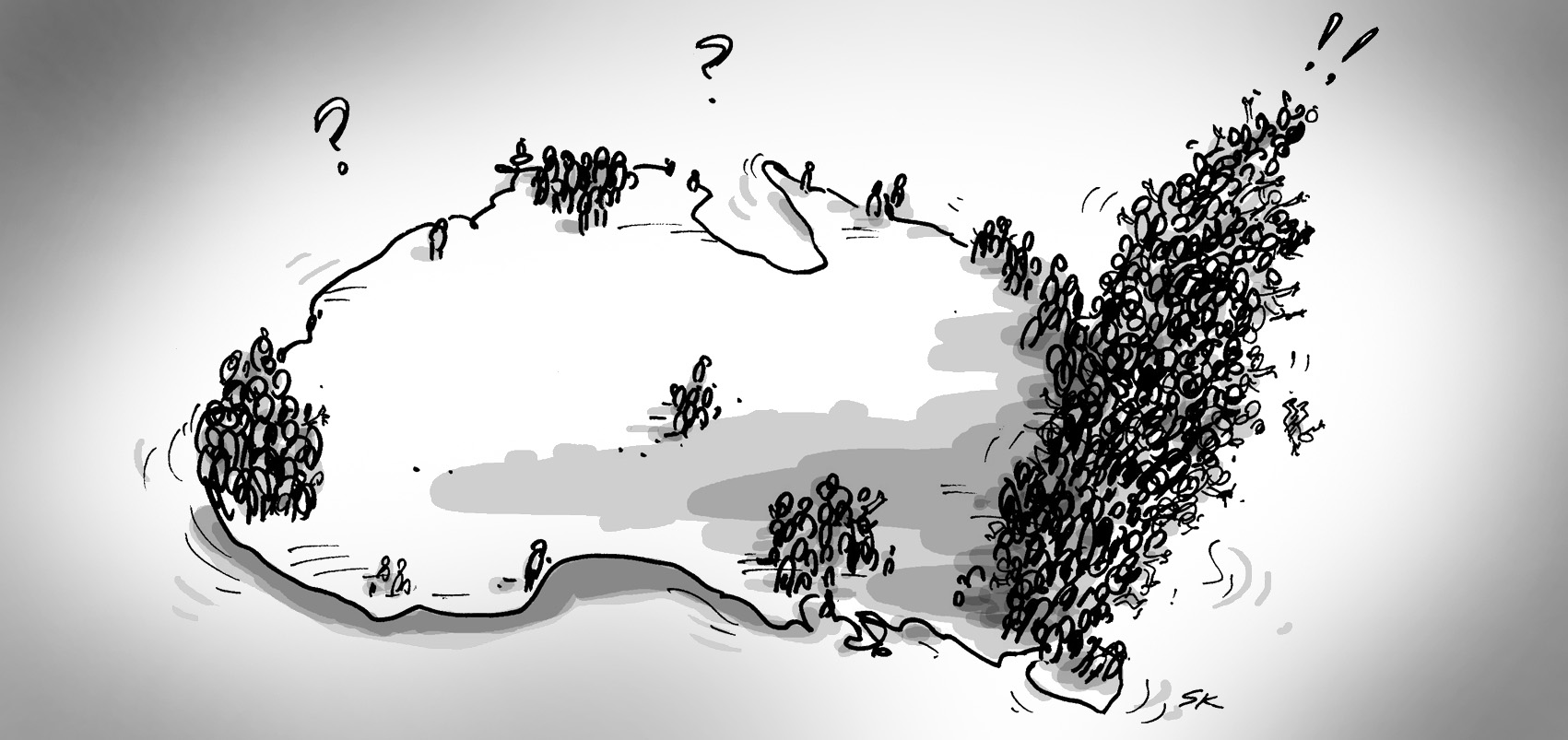

Changes in Employee jobs by industry 14 March 2020-4 April 2020

Source: ABS – 6160.0.55.001 – Weekly Payroll Jobs and Wages in Australia, Week ending 4 April 2020

This shows that all sectors of the economy have taken a hit, but essential services like Education and Electricity, water and waste have had hardly any downturn.

By far the biggest hits (somewhat predictably) are Accommodation and Food Services and Arts and Recreation Services (all those cafes, libraries and art galleries that have had to close). Interestingly Mining is down quite sharply as well, which I didn’t really expect.

Note that because this is payroll system data, it only relates to EMPLOYEES – the self-employed and business owners won’t be in there.

A few other key findings

- Women’s jobs and incomes have been impacted slightly more than men’s (5.7% jobs lost to 5.1%). This probably reflects the higher female workforce in those affected industries.

- Tasmania and Victoria are the two states with the biggest percentage decline in jobs.

- Total jobs numbers are 5.5% down Australia-wide over the 3 weeks. This is not the same as the unemployment rate but it does indicate that the next release of this key indicator could see our unemployment rate approximately double to around 10-11% – though Jobkeeper may trim this a bit.

- The most widely reported data out of this is that the very young workforce and very elderly workforce are most impacted by this, with the biggest decline in jobs being 8.1% for those under 20 and 8.5% for those over 70.

- For the very young, this is undoubtedly due to the high level of employment in the hospitality sector. But it’s worth remembering that the majority of people in this young age group are in education, while over 70s make up a very small proportion of our total workforce (~1%), as most are retired.

We will get a clearer picture on these harsh economic impacts on people’s lives with the next release of Labour Force, Australia (6202.0) which looks at the month of April, and any further releases of this collection. We’ll try to keep you up to date on this rapidly changing space, with new resources as they become available.