Esther’s recent blog on dependency ratios got me thinking. We are moving towards a time when we will have far more non-working population as a proportion than ever before, particularly as the baby boomers age into their retirement years. This has been known for some time, and was the impetus behind the introduction of compulsory superannuation in the 1980s, so people would fund their own retirement and not be a drain on taxes in their older years. I distinctly remember, going through university in the early 1990s, being told “There won’t be a pension by the time you reach retirement age, so you’d better save as much money as you can now”. But we’re now 20 years on, and there seems to be no sign of the age pension being removed. Would any government really commit the political suicide of dropping or significantly winding back social security for the aged? Can demographics provide the answer?

The age pension is the single biggest line item in the federal budget at just under $40 billion in 2013-14. Disability support adds another $15b and family tax benefit about $20 billion. Current budget estimates have this increasing at around $3 billion per year at the moment, or about 8% p.a. Add in income support for carers and aged care funding (generally provided by the states), which is growing even faster, and there is an increasing burden on the tax payer for our aging population.

There has been a lot of talk recently about encouraging people to work longer, and in fact the government in 2010 announced a small increase in the pension eligibility age, from 65 currently, to 67 – but this won’t affect anyone until 2018, when those born in 1953 reach the age of 65 and discover they have to wait an extra 6 months for the pension which is phasing up to 67.

This is only the beginning though. Every year now more and more people are entering their retirement years, as the baby boomers move into this age group. At the same time, those entering the workforce now are those born in the low birth rate years in the 1990s, so the workforce is supporting an increasing group of retirees. We have had record immigration in the last few years to offset this, but it’s still pretty significant, as the dependency ratio in Esther’s blog shows – we’ve now hit an older dependency ratio of 20.5 in Australia, the highest ever, and it’s continuing to increase.

What could happen to social security in coming years? Well here are a few possibilities:

- Significant increase in the pension age – to 75 or 80.

- Removal of the exemption of the family home from the assets test.

- Large penalties for elderly living in homes which are too large for them.

- Closure of loopholes allowing people to claim the pension while structuring their investments to have large amounts of exempt income.

- Increase in the superannuation access age to 70 or 75, forcing people to continue working.

But politics is all about popularity, and wouldn’t it be political suicide for any government to bring in such radical changes in a society which regards the age pension as a right? I’m sure we’ve all heard the line “I paid taxes all my life so I could get the pension now I’m old”. The idea that taxes are a form of retirement saving, when they have always been used to fund current infrastructure.

Well I think it’s all about the baby boomers. They have been the dominant trend in society ever since they were born, and I predict that the government will wait until they are safely in retirement age and receiving their benefits, then “grandfather” the old schemes and start making significant changes.

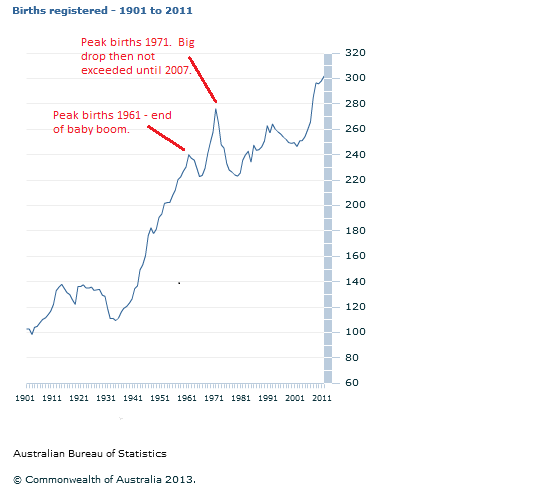

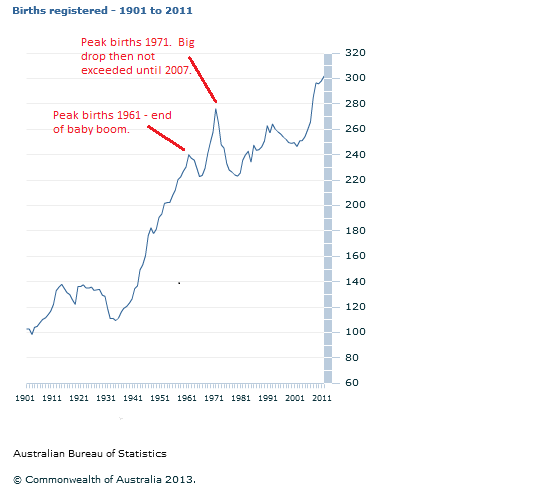

When will this happen? Well it all starts in 2026. Why? Take a look at this chart. Original from ABS Births, Australia, 2011 (3301.0). Annotations are mine.

The baby boom ended in 1962, with a sharp drop in birth rate. So the last baby boomers will turn 65 in 2026. At that time aged care and pensions will be a major strain on Australian society, and I predict that the government of the time will announce significant but not massive changes to pension and superannuation age. Perhaps an increase in the pension and superannuation age to 70 from 2026, removal of the family home asset exemption for new entrants.

The baby boomers will be “safely” (from a political point of view) past retirement age and continuing to draw their pensions, and with less people entering retirement there will be less angry voters each year for the government to worry about making these changes.

But up to 1971 there was still a big peak in births, and they will be reaching 65 through to 2036. So the really massive changes (pension to 80 or abolished, superannnuation to 75) won’t happen until after that. Every year after 1971 there was a big decline in births, so that there were actually 50,000 less births in 1979 than 8 years earlier. Also that’s getting into the generation who mainly have compulsory superannuation, so assuming the funds leave a little bit after taking managment fees and the stockmarket doesn’t crash too much, there will be some self-funding for those retiring at that age.

So anyway, that’s my prediction –

- Some increase in the pension and superannuation preservation age by 2026.

- Major increase in the superannuation age and possible abolition of the pension to new entrants by 2040.

Outlandish – maybe! I like making bold predictions! I want to stress that these are not the views of .id, just my own musings! I’m interested to hear your thoughts – please leave a comment! And in 2040, if I’m still around (and claiming my pension?) I’ll let you know if I was right!