When will the age pension be abolished?

Esther’s recent blog on dependency ratios got me thinking. We are moving towards a time when we will have far more non-working population as a proportion than ever before, particularly as the baby boomers age into their retirement years. This has been known for some time, and was the impetus behind the introduction of compulsory superannuation in the 1980s, so people would fund their own retirement and not be a drain on taxes in their older years. I distinctly remember, going through university in the early 1990s, being told “There won’t be a pension by the time you reach retirement age, so you’d better save as much money as you can now”. But we’re now 20 years on, and there seems to be no sign of the age pension being removed. Would any government really commit the political suicide of dropping or significantly winding back social security for the aged? Can demographics provide the answer?

The age pension is the single biggest line item in the federal budget at just under $40 billion in 2013-14. Disability support adds another $15b and family tax benefit about $20 billion. Current budget estimates have this increasing at around $3 billion per year at the moment, or about 8% p.a. Add in income support for carers and aged care funding (generally provided by the states), which is growing even faster, and there is an increasing burden on the tax payer for our aging population.

There has been a lot of talk recently about encouraging people to work longer, and in fact the government in 2010 announced a small increase in the pension eligibility age, from 65 currently, to 67 – but this won’t affect anyone until 2018, when those born in 1953 reach the age of 65 and discover they have to wait an extra 6 months for the pension which is phasing up to 67.

This is only the beginning though. Every year now more and more people are entering their retirement years, as the baby boomers move into this age group. At the same time, those entering the workforce now are those born in the low birth rate years in the 1990s, so the workforce is supporting an increasing group of retirees. We have had record immigration in the last few years to offset this, but it’s still pretty significant, as the dependency ratio in Esther’s blog shows – we’ve now hit an older dependency ratio of 20.5 in Australia, the highest ever, and it’s continuing to increase.

What could happen to social security in coming years? Well here are a few possibilities:

- Significant increase in the pension age – to 75 or 80.

- Removal of the exemption of the family home from the assets test.

- Large penalties for elderly living in homes which are too large for them.

- Closure of loopholes allowing people to claim the pension while structuring their investments to have large amounts of exempt income.

- Increase in the superannuation access age to 70 or 75, forcing people to continue working.

But politics is all about popularity, and wouldn’t it be political suicide for any government to bring in such radical changes in a society which regards the age pension as a right? I’m sure we’ve all heard the line “I paid taxes all my life so I could get the pension now I’m old”. The idea that taxes are a form of retirement saving, when they have always been used to fund current infrastructure.

Well I think it’s all about the baby boomers. They have been the dominant trend in society ever since they were born, and I predict that the government will wait until they are safely in retirement age and receiving their benefits, then “grandfather” the old schemes and start making significant changes.

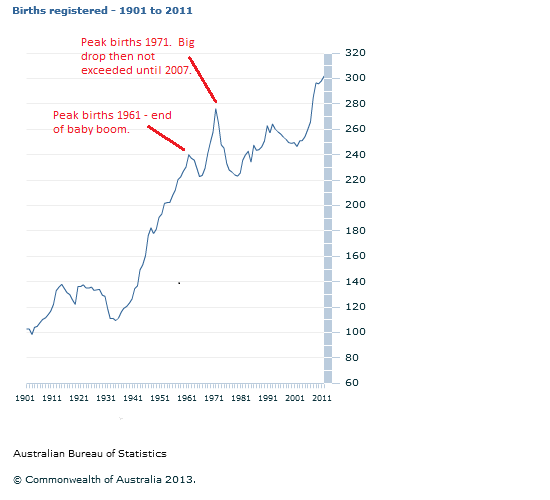

When will this happen? Well it all starts in 2026. Why? Take a look at this chart. Original from ABS Births, Australia, 2011 (3301.0). Annotations are mine.

The baby boom ended in 1962, with a sharp drop in birth rate. So the last baby boomers will turn 65 in 2026. At that time aged care and pensions will be a major strain on Australian society, and I predict that the government of the time will announce significant but not massive changes to pension and superannuation age. Perhaps an increase in the pension and superannuation age to 70 from 2026, removal of the family home asset exemption for new entrants.

The baby boomers will be “safely” (from a political point of view) past retirement age and continuing to draw their pensions, and with less people entering retirement there will be less angry voters each year for the government to worry about making these changes.

But up to 1971 there was still a big peak in births, and they will be reaching 65 through to 2036. So the really massive changes (pension to 80 or abolished, superannnuation to 75) won’t happen until after that. Every year after 1971 there was a big decline in births, so that there were actually 50,000 less births in 1979 than 8 years earlier. Also that’s getting into the generation who mainly have compulsory superannuation, so assuming the funds leave a little bit after taking managment fees and the stockmarket doesn’t crash too much, there will be some self-funding for those retiring at that age.

So anyway, that’s my prediction –

- Some increase in the pension and superannuation preservation age by 2026.

- Major increase in the superannuation age and possible abolition of the pension to new entrants by 2040.

Outlandish – maybe! I like making bold predictions! I want to stress that these are not the views of .id, just my own musings! I’m interested to hear your thoughts – please leave a comment! And in 2040, if I’m still around (and claiming my pension?) I’ll let you know if I was right!

I think you have missed the most likely solution in your list of possibilities – massive and ever increasing immigration.

This is the simplest and cheapest way for the govt to maintain the dependency ratio at something reasonable. Of course in the long run it is unsustainable, but when has that ever worried democratic governments on a three year election cycle!

The thing about Australian is that each generation following the baby boomers is slightly larger than the one before it. Provided you break generations up into consistent 20 year groups. So the generation from 1965 to 1985 is actually larger than the boomers. If you look at your birth rate chart, and smooth out it out a bit, you will see this. We don’t really have a baby bust like in other countries. Fertility crashed, births did not.

So there will never be a safe time to phase out pensions, because there will always be a huge block of the population dependent on it.

Also, if you do the numbers, the idea that pensioners are going to bankrupt the goverment is rubbish. We are talking about an extra 2-3% of GDP. 5% if you include healthcare.

Future workers are likely to be more productive thanks to automation 30 years from now, so we won’t need as many workers, which would lead to mass unemployment if the labour force wasn’t going to decline anyway.

We did actually have a baby bust, in the 1970s – 50,000 less babies born in 1979 than in 1971. It just doesn’t fit neatly into 20 year generations so that if you take 1965-1985, yes there are more people in it than the previous 20 years. But real life doesn’t work in 20 year blocks, and we will see significantly less people entering retirement age every year from 2035 onwards.

I agree fully – sometime in the future all those immigrants are going to need to retire. A joke and miss information or Logic!!!!

When compulsory super was introduced I assumed it was to be taken as a pension when the time for retirement came. This did not happen and resulted in super being withdrawn and spent instead. Surely compulsory super should mean compulsory pension even if some would need top up due to insufficient work for whatever reason.

I draw your attention to the ‘Welfare Act 1946’ and it’s repeal act of 1985.

In 1944, Labor Prime Minister (Ben Chifley) introduced 3 bills to establish the ‘National Welfare Fund’, to be funded by a compulsory Contribution (levy) of 1/6 in the pound (20/-) on all personal income. The Opposition Leader would only give bilateral support to these bills if the funds collected were held in a separate account and not general revenue. Prime Minister Chifley agreed and established The National Welfare Fund as at 01/01/1946. It was a ‘Trust’ Fund with the federal Parliament as ‘Trustee’. The compulsory contribution (levy) commenced as of this date. In 1950 the fund held almost 100,000,000 pounds. From this date onwards when Menzies was Prime Minister the levy was grouped with the Consolidated Revenue Account. The sabotage of the National Welfare Fund had commenced. All governments from this date raided the fund for general expenses and in 1977 Prime Minister Malcolm Fraser transferred the balance (Approx. $470,000,000) to the consolidated Revenue Account.

In 1985 the Labor Government repealed the act of 1945 thereby finally ending the National Welfare Funds Act. However, the 7.5% income tax levy was not repealed and to this day continues to be collected as a portion of Income tax revenue.

All persons in Australia who have paid personal income tax since 1946 have contributed to their age pension and as such the Age Pension is fully funded. It is not the fault of the age pensioners if the governments over the years have squandered their pension funds for general expenses.

About time someone put some facts into this ludicrous myth that pensioners bludge on people at work. It should also be noted that superannuation was only introduced in 1992 and the employer contribution was a mere 3% plus a lot of them didn’t even pay that add to that a lot of work was transient e.g. picking fruit, working on farms and wages were very low. A lot of pensioners only had thirteen or so years to save anything to contribute to their pension. Not to mention we were always told that our taxes contributed to our pension.

Well how can a person working 30 hours a week on $34,000 a year put money into super .And work on your feet all day even work to 67 years old .Im still paying my Hous off so what happens for me to live.

“The great man Menzies”” started the corruption and a total misuse of the monies collected for the Welfare Fund. So as. A Pensioner I don’t give a rats where the bloody Government gets the money from they better keep paying the age pension.the saying that “”””worked all my life and paid tax is very true.””Because the baby boomers and workers before Have worked hard and long hours. The current crop of workers or back since the nineties at least half have never worked or paid tax. They can’t start phasing out the pension in 2030.

It is a known fact that the “current crop of workers” are working more hours than ever before. We will also have to work until 70 years of age to access our superannuation. I do agree that the Baby Boomers should be entitled to a pension as compulsory superannuation wasn’t introduced until the 1980’s. What frustrates me is the attitude of some Baby Boomers that all other generations are inferior. Be careful what you preach. Gen X are your future politians and they will make the decisions regarding your aged pension.

With the current pension cuts and automatic cross checking via computer we now do not need all the Human Services personnel to check, so the pay rise that they want should be funded by staff cuts as private sector has to do and we could cut one ministers position and one department head and their staff as they are no longer required. also wondering which Sunday overtime will be worked to make up for the loss of the days pay for the planned strike? Poor Policies = Poor Planning = Poor Production = Poor Ministers= .With the pension rate at about $20,000. why do we pay refugees $56,000.Why is child care been funded by the tax payer the tax paid by the person receiving the child care is below the child care payment i.e a cost to the rest of the tax payers. it is about time that the politicians started to look out the period that they were elected for and put Australia first not their retirement fund

when will the government stop taking the tax that was introduced to fund the age pension?

1985; Australian Labor Government repealed acts No. 39, 40 and 41 of 1945 (The National Welfare

Fund Acts).

Yes Paul, they simply transferred what was 7% for age pension into general revenue, which of course disappeared. Was there any reduction in tax to compensate? No, of course not. They then force employers to fund their workers retirement by forcing them to pay super for each worker because there would be too many baby boomers for the reduced working population to fund, forgetting conveniently that every worker who had paid tax had funded their own retirement. In other words, a compulsory pay rise, funded how? Employers had to take it on the chin. Meanwhile, government ministers awarded themselves 69% super, which of course was paid for by taxpayers. This was reduced in the early 2000s when the public found out and complained, but is still 16%. Plus they get a high percentage (something like 75%) of their most recent income as a pension on top of that super. Look what government ministers retire on now, something like 10 times the average pension. They are parasites, no better than dictators that they loudly condemn. Yet they blame baby boomers, who worked all their lives to have their pension stolen from them. There’s no answer by voting for the opposition, it’s the same result. The politicians determine their own salary, pension, super and retirement perks, and they are MILES above standard workers rates. Animal Farm was so accurate: ‘All animals are equal, but the pigs are more equal than the rest’.

Immigration is always a Factor and if carefully managed alongside births it solves the so called problem. Pensions are not a problem at all. If a person has not received any employer super[unlikely] then they receive a full pension approx say $30000 a year,paid monthly,(whatever is deemed enough to live on) state pension. If they have employer assumed super then again they receive up to $30000 from that or a combination of Employer assumed pension and “state pension” which a lot of people currently would fall into this category. Obviously the more your employer has contributed the less the state has to cough up. The salary sacrifice element which you have paid a CONTRIBUTION TAX on of currently 15% should then be totally exempt from government interference and should be paid in any form the OAP prefers. All this fear mongering about family home inclusion in assets test and raising the pension age is a nonsense. If people are increasingly having more in their SUPER surely that solves the problem except for Crashes in the Stock Market and that is where are NOW HONEST Banks and super fund managers advise and manage our funds. People should be encouraged to SALARY Sacrifice and government work out what is a fair tax currently 15%. THE PENSION AGE SHOULD BE 65 FOR EVERYONE. THERE SHOULD BE NO COUPLES BULLSHIT. Life is too complex for (couples?!#$% me and my dog) these days. Treat people as individuals and let them have a fulfilling RETIREMENT. Actual figures for the above could be fairly agreed upon by a number of think tank bodies not just government which currently seems incapable of working out any system.

People living in $5m+ homes should not get the age pension. When the pension was introduced, the age to get the pension was around life expectancy. So only those that outlived life expectancy got the aged pension. This means that the age should theoretically be raised to around 80. People these days are just whingers and expect the government to pick up the tab for everything. Well guess what, we the taxpayer are the government. We are where the governments money comes from. All super should only be allowed to be taken as a pension. Stupid idea to save years for retirement and allow people to blow it all on overseas holidays., new cars etc. and then go on the age pension. No government or defined benefit fund is going to be able to fund their liabilities around pensions going forward. Immigration doesn’t work, as migrants don’t assimilate, which leads to cultural problems. Child care should not be funded by the government. People! look after you own kids and stop the greed. Note I have a child and I don’t scab off the government. Overall, people want the government to fund their needs so they can blew their disposable income on their wants, but guess what, your income is meant to pay your needs and if you are lucky enough to have something left over, then you can get your wants. To all the whingers out there, the median person on the entire planet has around $4200 USD to their name, which includes property, super, cash (effectively everything). Consider yourself lucky to live in Australia! If your are on the dole in Australia, your are wealthy by world standards.

If only we paid median prices for goods and housing in Australia… wealthy in notional terms sure, but convert into actual goods and services and the picture is not so great!

We paid for our pensions all our working lives,,, so don’t get the blody idea we are bludging on anyone.

Blame your politicians who pull the funds out of the fund in it’s early days , and never started another one….yet continued taking our taxes to support their BLUDGING LIFESTYLES.

Have never bludged off anyone my entire life, and now , when I was looking forward to a pleasant time in my later years , I get this bloody bullshit to put up with for the rest of my life.

That’s what you get for believing the freeloading spongers in Canberra.

A friend moved to England, and after several years she reached pension age, and has received the full pension, no penalies, no deductions, and she still holds a full time job, and pays her normal taxes.

So, go to hell Australia, just show how gutless and patheitic you are , that you will even deprive those who worked to build the country so you could have a good life, you make me sick.

Thanks for the comment. I don’t want to get into a debate about whether the pension is a right or a privilege. The article was just looking at when, from a demographic point of view, it might be seen as politically expedient to abolish the pension. That’s probably extreme, and I don’t think it’s likely that the age pension will be completely removed. But I still think once the baby boomers are all through to retirement age, we will see a substantial tightening of tests to qualify for the pension – eg. including the home in the pension assets test, more stringent income tests, increasing of the age to qualify etc. – so the pension would become a safety net only, not something to be planned for.

With 27 years until I reach 65 should I put extra into my super? My fear is that the rules around how I access that money in the future will be very tight but the tax incentives currently are tempting.

Hi Ryan,

We are not financial advisors and can’t give specific advice for you I’m afraid! It’s certainly possible that the rules around accessing super and preservation age will change in the future. As the nation gets older, there will be pressure to increase the preservation age, to match increases in the pension age. There is certainly a good tax incentive to put more into super, but the tradeoff is being unable to access it until the preservation age. Everyone needs to weigh that up for their individual circumstances.

Pensioners should not be the scapegoat for solutions. The amount they save was tax long time ago.

Instead of punishing with draconian and clandestinely design harsh means test, allow them to do business with 100 percent government support to avoid failures.

One good example is;

Mostly pensioners have dead asset who can in turn give better benefit to engaged any form of productive means by downsizing, using the rest for that purpose after securing a cheaper options where to live.

Then “tax them like everyone after using entitlements as a threshold” the tax collected can add income funds to the government, including GST too.

It can also promote employment and more tax payer joining the evolution of economy.

Currently means test has no benefit and it only breeds laid back Australian as incentives no where to be found.

If we don’t make an effort to better ourself we will be the same tomorrow while other countries are flourishing,

Election comes,

Lets vote to a politician who knows how listen next election.

“From a forlorn hopers”

Clemo

Mybe the banks and the rich should carry there fair share